What Is Meant By Rebating In Insurance

In simple language, when an insurance company pays you the amount you claimed in a situation where the third party was responsible for the damage in question, you subrogate your rights to the. Any insurance policy or to take out a policy of insurance with another insurer.

Rebating In Insurance Means - Insurance

Archaic to reduce or diminish (something or the effectiveness of something)

What is meant by rebating in insurance. Rebating is a way of making a potential insurance client buy the insurance product by returning the commission meant for the broker or agent as compensation or payment for the sale. An example of rebating is when the prospective insurance buyer receives a refund of. (commerce) to deduct (a part) of a payment from (the total) 2.

An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. For advisers, it means reduction in their earnings and soon many advisers will quit. Commission‑rebating means that the intermediaries are setting the premium paid by the consumer, which means that an intermediary is price‑setting.

Rebating is illegal in the majority of states. Check your insurance terms to see what applies to your policy. 701 pennsylvania avenue nw, suite 750.

However, the rebating laws allow giving something of value where it is specified in the insurance contract. (commerce) a refund of a fraction of the amount payable or paid, as for goods purchased in quantity; Product manufacturers will be required to rebate grandfathered commissions to clients for any products still in use after january 2021 under proposed new regulations.

Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. It is, however, a practice that can lead to ethical lapses. The federal government also wants to force product manufacturers to keep records on the amounts rebated.

Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the. Commercial prescription drug insurance is a policy that is designed to cover part of the cost of medications prescribed by a doctor, and which are filled by a. The council is currently building out a new section on rebating law.

Rebates can be made in the form of cash, gifts, services, payment of premiums, employment, or almost any other thing of value. Advisers have the right to earn a decent living just like everybody else. Their commission (commission‑rebating) to lower the price that consumers pay.

An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. A plan of insurance covering certain lines of insurance which is offered under the auspices of a large employer or other homogeneous group, such as a labor union or fraternal organization, where a large number of persons are covered by one insurance company with the idea of convenience (principally payroll deduction and economy). Knowingly making any misleading representations of any insurance policy for the purpose of inducing a person to lapse, forfeit, surrender etc.

Jul 6, 2020 — rebating is a way of making a potential insurance client buy the insurance product by returning the commission meant for the broker or agent as. Top 10 what is rebating in insurance answers If they attempt to boost their own commissions by persuading their customers to switch insurance products instead of automatically.

Rebating in another example rebating was allowed because the “agent” was “really” a technology hr company selling insurance on the side. Afa attacks grandfathered commission rebates. The insurer might also promise discounts on premiums or even gifts.

Rebates can be made in the form of cash, gifts, services, payment of premiums, employment, or almost any other thing of value. Rebating — returning a portion of the premium or the agent's/broker's commission on the premium to the insured or other inducements to place business with a specific insurer. That was the political decision.

In the insurance business, rebating is a practice whereby something of value is given to sell the policy that is not provided for in the policy itself. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. Attempting to settle a claim on the basis of an altered application b.

Insurers must use filed rate credits or have supporting methodology.

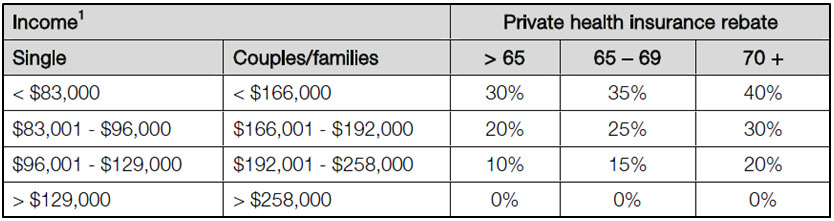

The Private Health Insurance Rebate Explained Iselect

Rebating In Insurance Boon Or Bane - The Case Centre

The Private Health Insurance Rebate Explained Iselect

Online Ethics At Work 3-hours Ethics - Ppt Download

Private Health Insurance Rebates Berita Riset Dan Analisis The Conversation Laman 1

Why Regulators Should Dump Anti-rebating Laws

Get 50 Commission Rebate From One Stop Insurance Shop Compare Insurance Plans With Diyinsurancecomsg Investment Moats

Rebating In Insurance Means - Insurance

Rebating In Insurance Means - Insurance

What Is Rebating In Insurance Definition Risks Pros And Cons

Rebating In Insurance Means - Insurance

Pharmacy Benefit Management Industry Definition

Rebates Nondiscrimination And Compensation Alaska Division Of Insurance

/guidelines-for-insurance-specs-(400x533).tmb-.png?sfvrsn=8)

Rebating Insurance Glossary Definition Irmicom

Insurance Rebating Everything You Need To Know Insurance Pro Blog

Understanding Rebating Rules For Insurance Advisors Edge

Changes To Private Health Insurance Misso Wealth Management

Private Health Insurance Rebate And How It Affects Your Tax Return - Canale Tax Accounting

Article Brief Time To Dust Off The Anti-rebating Laws