A Whole Life Insurance Policyowner Does Not Have The Right To

If the policy does not list a successor owner, then your wife’s will would determine who inherits her assets, which would include the life insurance policies on your children. Rob recently died at age 60.

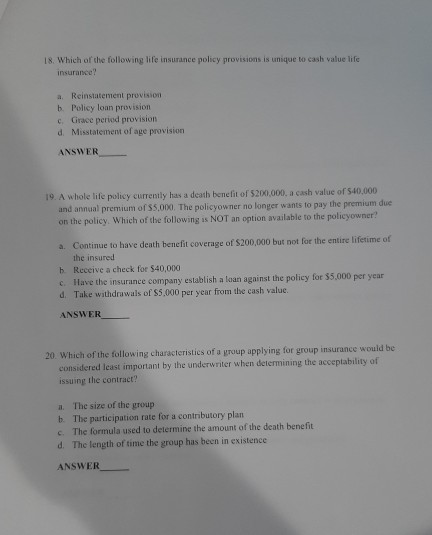

Solved 18 Which Of The Following Life Insurance Policy Cheggcom

Are paid directly to the insured's creditors, with any remaining balance forwarded to the beneficiary.

A whole life insurance policyowner does not have the right to. Collateral assignment (a collateral assignment provision allows a person to temporarily give up a portion of their ownership rights to secure a loan.) a provision that allows a policyowner to temporarily give up ownership rights to secure a loan is called a(n) disability The policyowner is the person who has control over the policy. A life insurance application must be signed by all of these, except:

The insured might be the owner of the policy or might not. If she does not have a will at the time of her death, the probate. Renew the policy at lower current rates than would be the case in a standard policy renewal.

Otherwise known as the right to examine, the free look provision allows the policyowner 10 days from receipt to look over the policy and if dissatisfied for any reason, return it for a full refund of premium. The owner can have outright ownership of the policy or just “incidents of ownership.” This is right up until the insured person passes away.

A life insurance policyowner does not have the right to. M purchases a $70,000 life insurance policy with premium payments of $550 a year for the first 5 years. A life insurance policyowner does not have the right to collateral assignment a provision that allows a policyowner to temporarily give up ownership rights to secure a loan is called a(n)

This person is called the insured. When there is a named beneficiary on a life insurance policy, the death benefits. Rob purchased a standard whole life policy with a $500,000 death benefit when we was age 30.

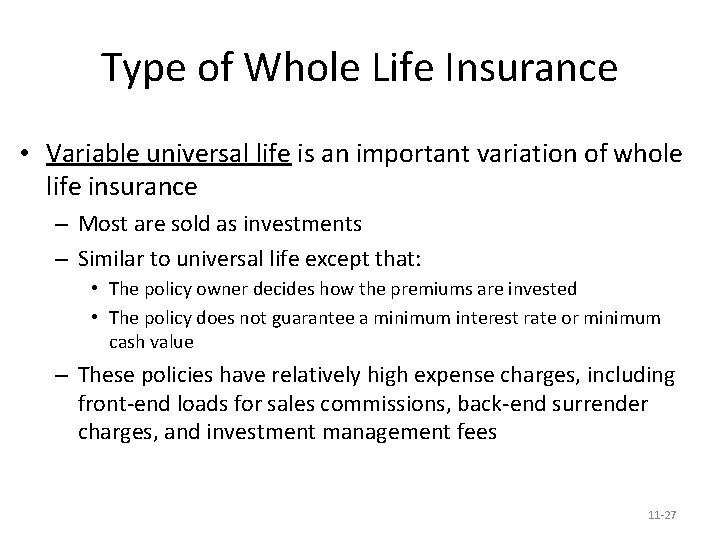

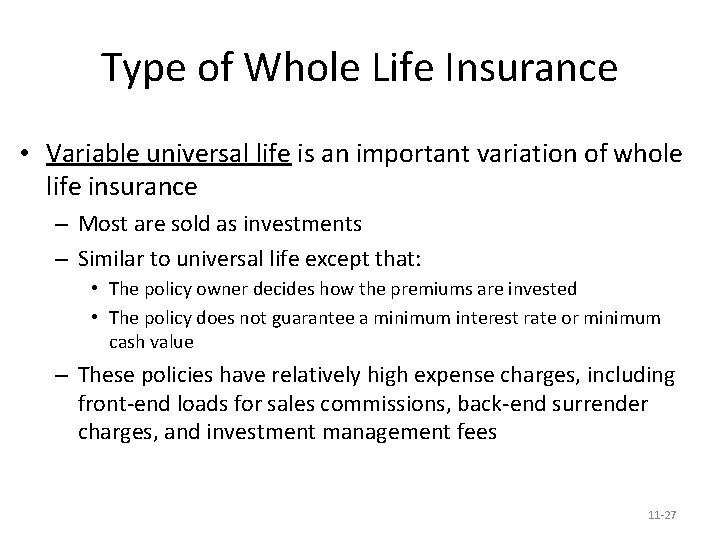

The death benefit would be. A life insurance policyowner has the right to control the economic benefits of the policy. Which statement is true regarding variable whole life insurance policy.

Annuity a contract that provides for the liquidation of all or part of an estate through periodic payments is known as an annuity. While the payer of the policy premiums does not necessarily have to be the owner, the cash value of the policy becomes the owner’s to control. The application is included as part of the contract and if the policyowner made false statements on their application, the life insurance company the right to terminate the contract.

Term life insurance your way. N is covered by a term life policy and does not make the required premium payment which was due august 1. Are directed to a trustee if the insured has any outstanding debts.

If t wishes to change the beneficiary, t must obtain permission from the beneficiary Who the policyowner is and what rights the policyowner is entitled to. His insurance agent told him the policy would be paid up if he reached age 100.

They also choose who the beneficiaries are and can change them at any time. The face amount will remain at $70,000 throughout the life of the policy. The free look period starts when the policyowner receives the policy (policy delivery), not when the insurer issues the policy.

Take out a policy loan. S dies 5 years later in 2008 and the insurer pays the beneficiary $10,500. Ad term life insurance made easy.

What does it mean to be a policyowner? The automatic premium loan provision is designed to. They are responsible for making sure the premiums are paid.

Tis the policyowner for a life insurance policy with an irrevocable beneficiary designation. S buys a $10,000 whole life policy in 2003 and pays an annual premium of $100. A life insurance policyowner does not have the right tochange a beneficiaryselect a beneficiarytake out a policy loanrevoke an absolute assignment.

Once a term life insurance policy has lapsed, it cannot be reinstated. At the beginning of the sixth year, the premium will increase to $800 per year but will remain level thereafter. Which military service exclusion clause would pay upon his death?

Ad term life insurance made easy. A life insurance policyowner does not have the right to. Term life insurance your way.

The present cash value of the policy equals $250,000. Insurance companies can charge an interest rate based on the policyowner’s credit report. Kurt is an active duty serviceman who was recently killed in an accident while home on leave.

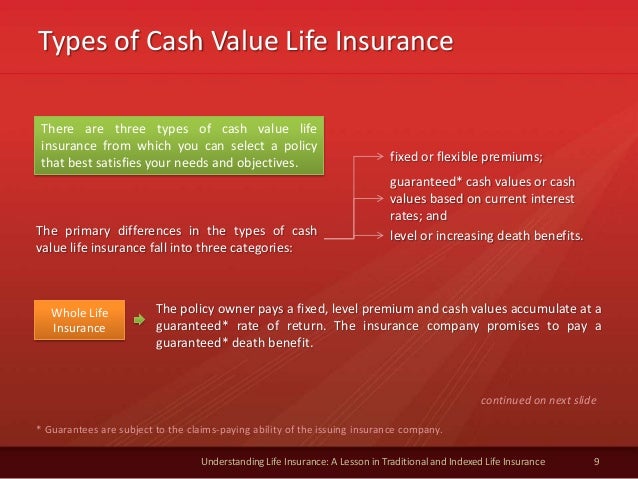

The owner of a life insurance policy is entitled to 100% of the cash value of the policy while the policy is still in force and before the insured person dies. A life insurance policy ensures the life of a person. So it’s important to understand what it means to be a policyowner and the various forms of policy ownership.

Life Insurance Needs Types Of Life Insurance Policies

How Much Life Insurance Should You Have Centsai Life Insurance Companies Life Insurance Life Insurance Policy

Life Insurance

The Ins And Outs Of Life Insurance Policy Ownership - Coastal Wealth Management

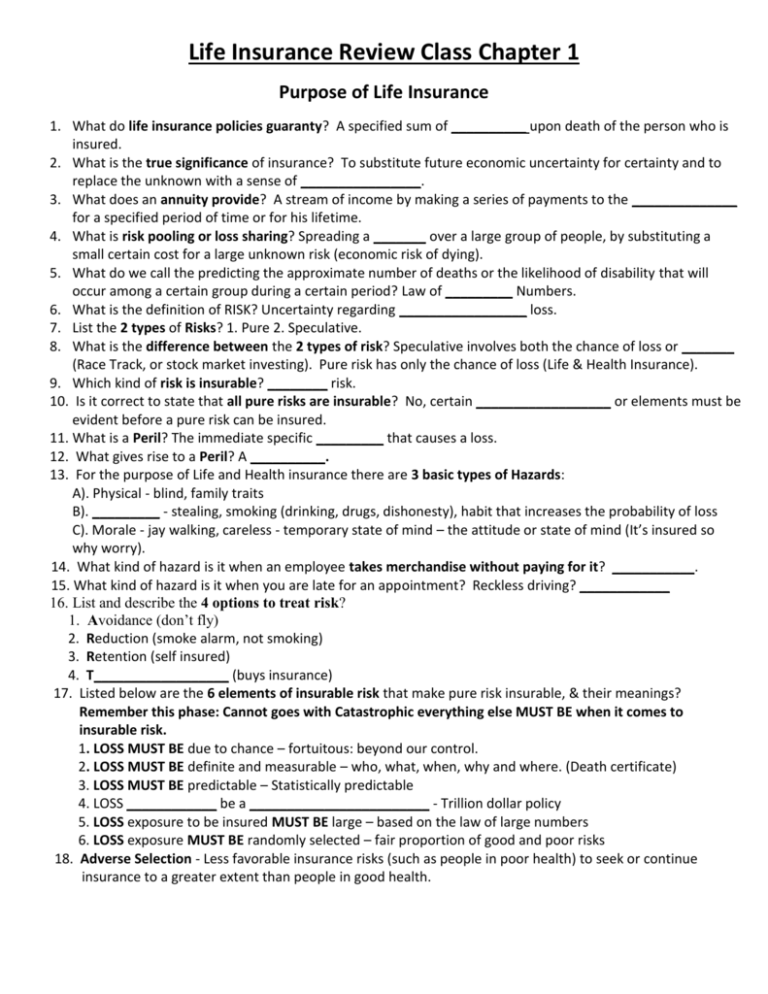

Life Insurance Review Class Chapter 1

Life Insurance Needs Types Of Life Insurance Policies

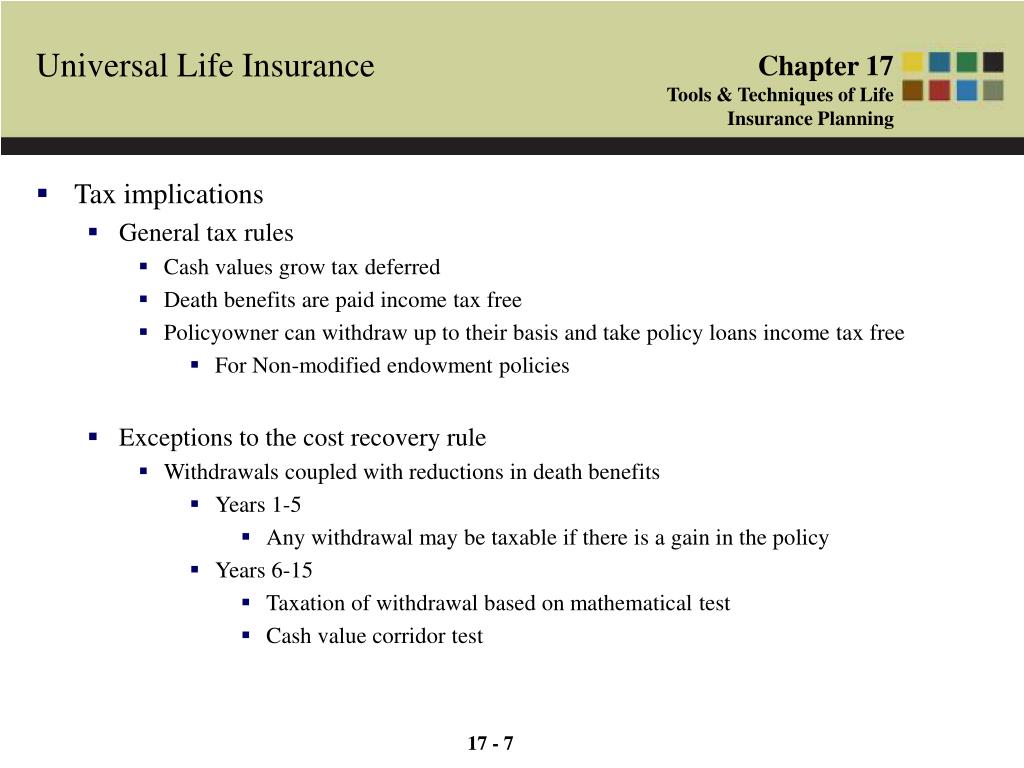

Ppt - Universal Life Insurance Powerpoint Presentation Free Download - Id5881477

Life Insurance Policy Owner Whats The Difference Quotacy

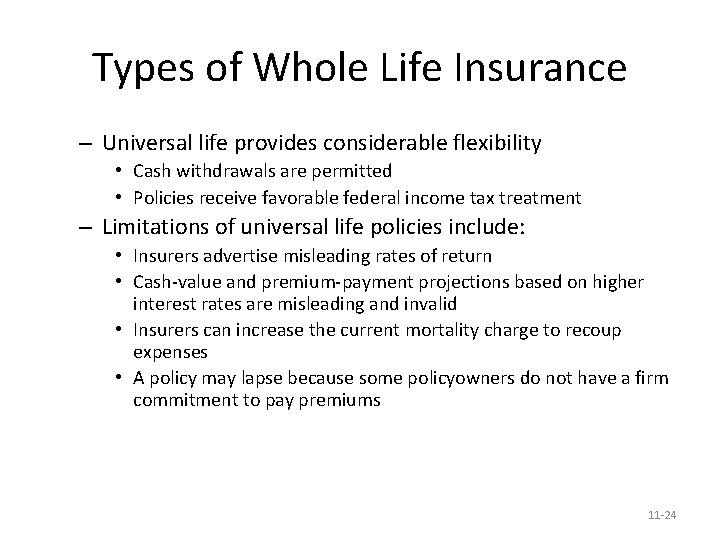

Whole Life Insurance

A Whole Life Insurance Policyowner Does Not Have The Right To - Ark Advisor

Denied Life Insurance Due To Lapse Will A Policy Pay Out Life Insurance Lawyer

Life Insurance Policy Owner Whats The Difference Quotacy

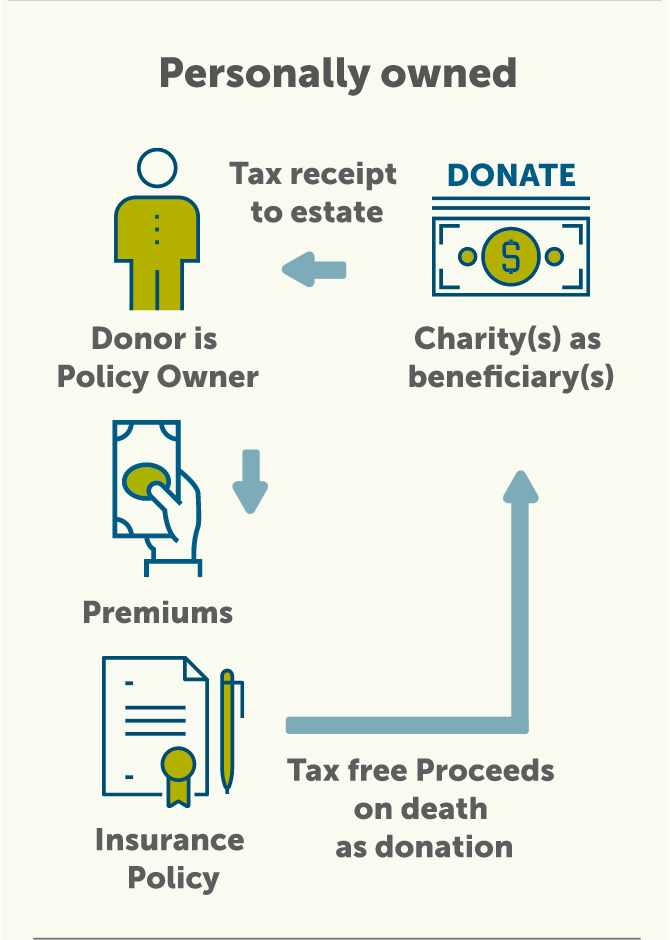

Life Insurance Is Tax Free Well Mostly And Usually But Not Certainly Not Always Life Insurance Life Insurance Premium Life Insurance Policy

1 - 1 Introduction To Life Insurance Principal Uses Estate Building And Conservation Income Needs Of Dependants Federal And State Death Taxes - Ppt Download

Life Insurance Needs Types Of Life Insurance Policies

Life Insurance Needs Types Of Life Insurance Policies

Life Insurance And Tax How To Save Your Money Empire Life Empire Life

Variable Reviewer Pdf Life Insurance Investing

What Is Final Expense Life Insurance Quotacy Life Insurance Policy Final Expense Life Insurance Life Insurance For Seniors