Progressive Renters Insurance Additional Interest

It's a simple notification system that usually requires no additional fees for your. Most companies can add this during the application process or immediately afterward.

Video Coverager Calls Out Progressives Homequote Explorer Before It Does

We can add an ‘additional interest’ to your renters insurance policy and make it effective the same day requested.

Progressive renters insurance additional interest. This allows them to be notified if the policy lapses or cancels so they can. Do you need help with contracts, insurance requirements, additional insureds, leases or equipment rental? If your landlord required you to have renters insurance and list them as.

Bundle auto & renters insurance. I am getting renters insurance through state farm, and the apartment complex i will be moving into requires the declarations page with the business listed as additional interest.after contacting state farm to update my policy, the agent sent me a new declarations page with my landlord listed as an additional insured.i asked state farm about this difference, and they said those terms are. An interested party is someone who is notified if you cancel or fail to renew your renters insurance policy.

Insurance is the first line of defense when something goes wrong. Granted, premiums vary based on both the amount of coverage and the deductible. An additional interest is a party who may be interested that an item is insured, but doesn't have any ownership in that item and therefore they cannot be listed as an additional insured.

A company or person who has been named as an additional interest insured on a policy can be liable for an accident that involves an insured person or vehicle. Be sure your renters insurance policy lists progress residential as an additional interest and references this address: Get both an auto and renters insurance policy from progressive and save an average of 3% on your car insurance.δ.

You can see that the terms additional insured and additional interest are both listed together in our car. It is a great idea for an owner to be listed as an additional interest, also known as an interested party or party of interest, on a renters insurance policy. This will let them know if the policy has lapsed or when you have renewed your policy.

There may be subtle differences in what they mean; In the context of renters insurance, an interested party is an individual or entity who is included for notification on the policy’s status. If a unit owner is responsible for.

Po box 38015 albany, ny 12203. It’s important to note that renters insurance is different from home and landlord insurance, both of which are intended for property owners and won’t provide the specific coverage a. Insurance plans can cover everything from disasters, like a fire, burglary and vandalism.

Quote & buy renters insurance online today. The title of “additional interest” affords no coverage to the listed party. For example, a condominium association would have an interest in all unit owners within the complex having insurance.

Additional insured and additional interest basically means the same thing when they are discussed in regards to car insurance. We offer a choice among maine’s preferred business insurance companies. If that's an additional insured, what's an additional interest?

A common practice for renters is to place their landlord as an “additional interest” on the policy. It allows us to be notified when changes or cancellations occur so no fees are charged on the resident’s account due to any miscommunications. (see disclosure) see more on bundling insurance ›.

The named additional interest can’t make claims against your policy, other than a liability claim that anyone you may have injured can make. Some landlords may require you to add them as an additional interest; By being listed on the policy, the additional interest is assured that they have the most current policy status at all times.

If you want to cover $100,000 in personal property rather than $10,000, expect to pay a significantly higher premium. Additional renters coverages can be added to a policy, including special coverage for jewelry and/or other high value items. Automobile insurance companies tend to interchange the terms.

According to data from the insurance information institute, the average renters insurance policy cost $180 per year in 2017, or about $15 per month. Aftermarket parts, not made by the original manufacturer, are sometimes used to replace damaged parts in a vehicle. All residents on the lease must be listed on the policy and your policy must have at least $100,000 of liability coverage.

For a free renters quote today, call toll free: How much is renters insurance?

Customer Service Number Progressive Auto Insurance Di 2021

Progressive Renters Insurance Review Pros Cons Pricing And Features

Pin On Templates Printable Free

Is Progressive Auto Insurance Any Good In 2021

Progressive Renters Insurance Review - Coverage Costs Lendedu

How To Add An Interested Party To A Renters Insurance 8 Steps

Progressive Auto Insurance Fax Number In 2021

Progressive Renters Insurance Review Pros Cons Pricing And Features

Progressive Insurance Review 2016

Progressive Renters Insurance Review Pros Cons Pricing And Features

Progressive Insurance Review 2021 Ratings Cost And Complaints

Progressive Insurance Review Auto Homeowners And Life Insurance

Progressive Car Insurance Bill Pay Ten Simple But Important Things To Remember About Progr In 2021 Progressive Car Insurance Progressive Insurance Car Insurance

Our Partners Detail Mask Insurance Agency

Progressive Renters Insurance Review Pros Cons Pricing And Features

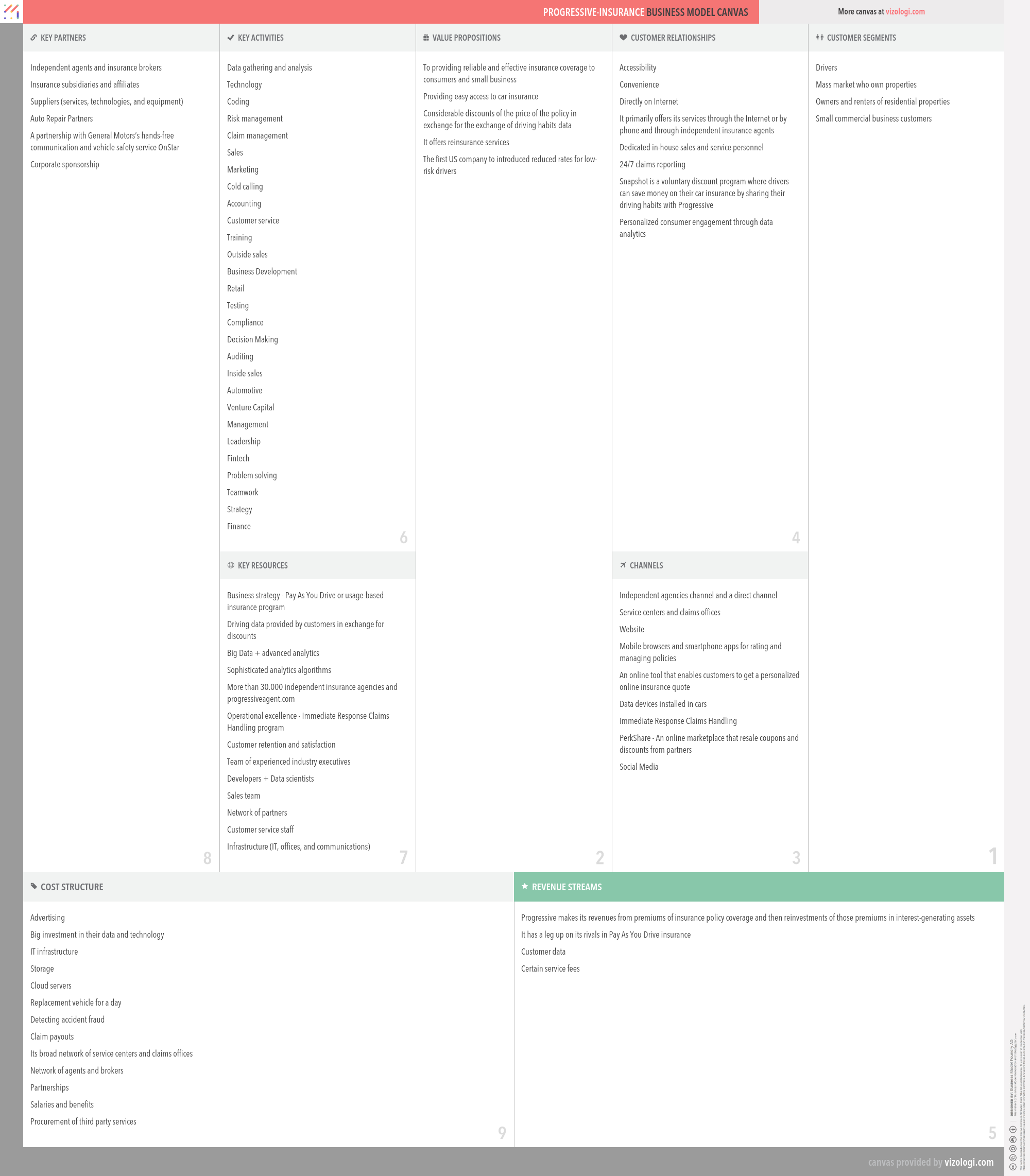

What Is Progressive Insurances Business Model Progressive Insurance Business Model Canvas Explained - Vizologi

Progressive Renters Insurance Review Forbes Advisor

Progressive Insurance Review Auto Homeowners And Life Insurance

Safe Auto Insurance Agent Near Me In 2021