Is Life Insurance An Asset For Medicaid

Life insurance may be a countable asset towards medicaid's $2,000 limit for nursing home benefits and is always countable towards va asset limits. And that means that medicaid cannot use it to recover costs.

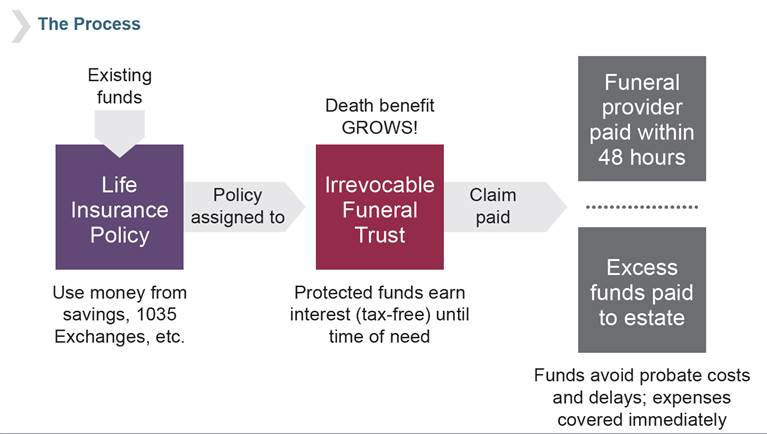

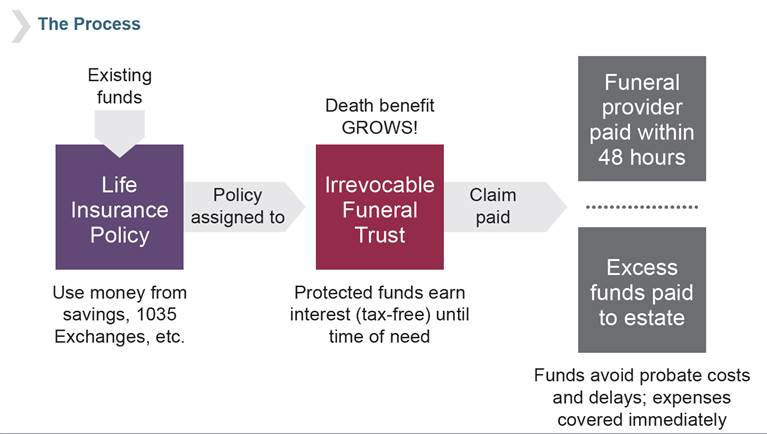

Asset Protection

You are allowed a final expense policy when going through a medicaid spend down, so the policy might be able to be designated for that.

Is life insurance an asset for medicaid. With whole life insurance, it doesn’t expire and lasts your whole life. A medicaid applicant may own one. The medicaid applicant will be asked to.

If a medicaid applicant has term life insurance, it doesn’t count as an asset and won't affect. Affordable, flexible term life insurance at your pace. Mortgage lenders do typically count whole life policies as one of your assets when considering whether or not to lend you money for a house.

If a medicaid applicant has term life insurance, it doesn’t count as an asset and won't affect medicaid eligibility because this form of. But depending on the type of life insurance and the value of the policy, it can count as an asset. And that asset is countable for medicaid purposes.

Term life insurance cannot be cashed out and thus has no value that is not countable. Here are some guidelines according to medicaid rules: What you can and can’t keep with medicaid:

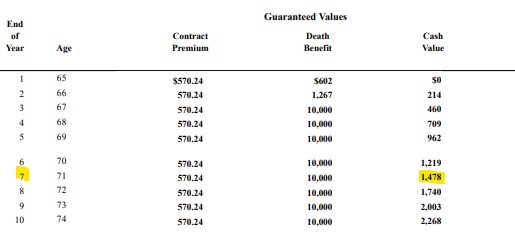

Life insurance policies are usually either term life insurance or whole life insurance. Implications of having life insurance as an asset. However, you must keep in mind that the cash surrender value of any insurance policy you own is considered an asset during your life.

Term life insurance does not impact medicaid eligibility, as it is not counted towards the asset limit. That means your cash value life insurance, or permanent life insurance policy, is not an “exempt” or “qualified” asset under the medicaid rules either under the federal or various state rules. In terms of life insurance, medicaid has no problem with your owning life insurance or any other asset in that matter.

This type of insurance policy provides coverage for a limited time, which may be as short as one year and as long as 30 years. Life insurance is an asset that is looked at by medicaid when determining eligibility. The owner has legal rights and can access the funds at any given time, since a medicaid applicant cannot have more than $2,000 in assets, having access to the additional funds in the life insurance policy.

Ltss services include institutional care such as a nursing home or assisted living. Life insurance is an asset. Is life insurance considered a “countable asset under medicaid”?

In order to qualify for medicaid, you can't have more than $2,000 in assets (in most states). That is why proper retirement planning is so vital to your overall wealth building strategy. Unlike other insurance products, life insurance absolutely can be counted as an asset.

But not all life insurance policies are the same and so they are not all treated the same way either. It must be counted as an asset. On the other hand, whole life insurance accumulates a cash value that the owner can access, so it can be counted as an asset.

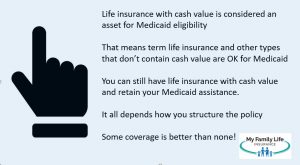

Whole life or universal life insurance that has a cash value can be considered an asset for medicaid purposes. As noted above, whole life is usually counted as an asset and term life usually is not. According to the medicaid policy manual section 1660.0553 on life insurance :

Along with that, whole life insurance accumulates a cash value that the owner can access. Whether it is a term life insurance policy or a whole life insurance policy can provide two different outcomes. When it comes to life insurance medicaid is not concerned with the insured of a life insurance policy or who the beneficiary is but rather who is the owner of the policy.

Affordable, flexible term life insurance at your pace. In other words, the insurance policy could put you over the asset limit. However, when thinking about medicaid, term life insurance isn’t considered an asset and won’t affect your eligibility for medicaid.

Does medicaid count life insurance as an asset? One negative aspect of having life insurance assets or any assets for that matter is how these assets affect medicaid eligibility. The cash value of a life insurance policy is included as an asset.

If a medicaid applicant has term life insurance, it doesnt count as an asset and won’t affect medicaid eligibility because this form of life insurance does not have an accumulated cash value.

Do Life Insurance Policies Affect Medicaid Eligibility - Agingcarecom

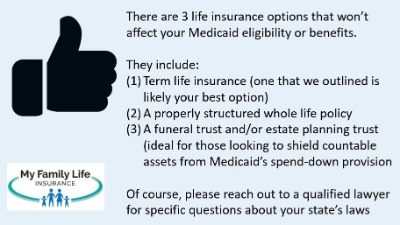

3 Ways To Obtain Life Insurance And Keep Your Medicaid Benefits

Can A Nursing Home Take Your Life Insurance

.jpeg)

Medicaid And Life Insurance

Life Insurance Counts As An Asset Ssi Medicaid Fafsa Life Insurance Life Insurance Premium Life Insurance Policy

Medicaid Spend Down Rules On Life Insurance - Options Explained

3 Ways To Obtain Life Insurance And Keep Your Medicaid Benefits

Is Life Insurance An Asset Why It May Be The Most Important Asset You Own

How New Jersey Medicaid Treats Life Insurance Hanlon Niemann Wright Law Firm New Jersey Attorneys

Can A Nursing Home Take Your Life Insurance

Can A Nursing Home Take Your Life Insurance

Will Medicaid Consider My Life Insurance To Be An Asset - Njcom

Can Life Insurance Affect Your Medicaid Eligibility

3 Ways To Obtain Life Insurance And Keep Your Medicaid Benefits

How To Use A Life Insurance Policy To Pay For Long-term Care - Agingcarecom

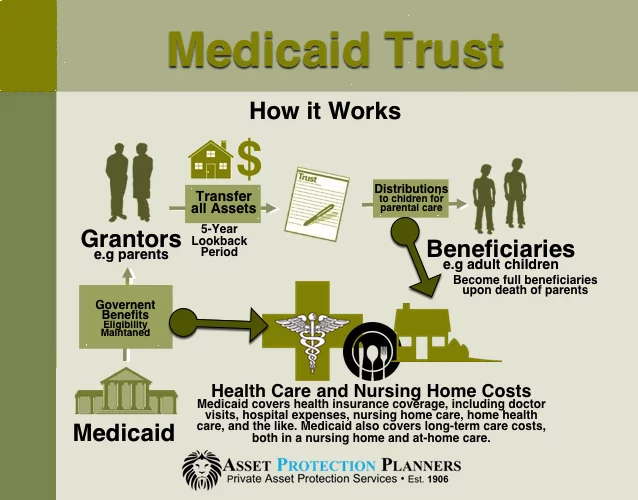

Medicaid Trust For Asset Protection From Nursing Home Costs

Download Our Medicaid Life Insurance Burial Rules - Software Development Hd Png Download - 640x704 6655562 - Pinpng

Will Medicaid View My Life Insurance As An Asset - Callahan Financial Services Group

3 Ways To Obtain Life Insurance And Keep Your Medicaid Benefits