General Aggregate Limit Insurance Term

General aggregate limit insurance coverage. It places a ceiling on the insurer's obligation to pay for bodily injury, property damage, medical expenses and lawsuits that may occur to a business during the policy's term.

General Liability Insurance Everything You Should Know Landesblosch

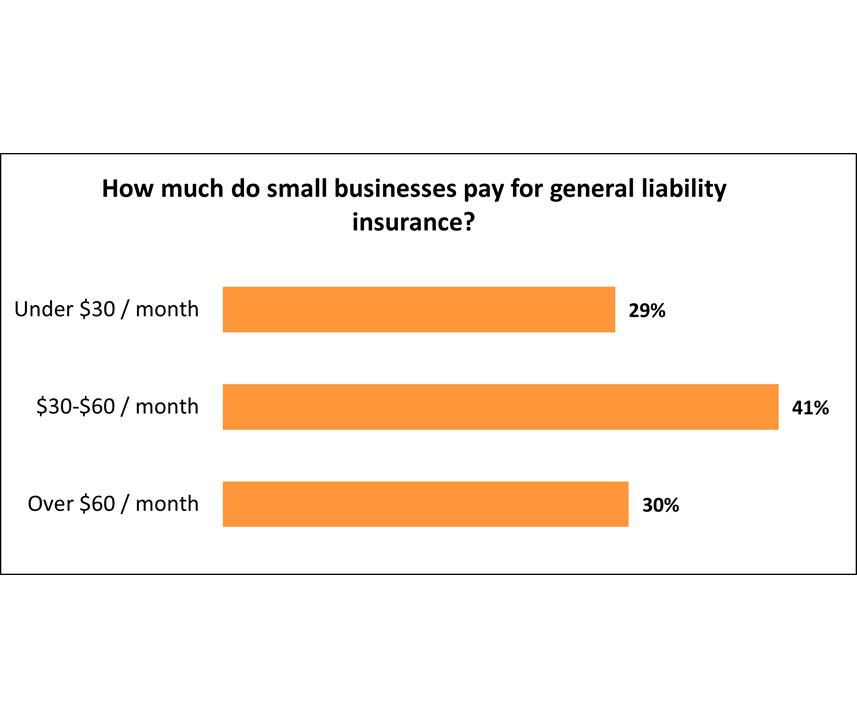

As with other kinds of insurance, the higher the coverage the greater the premium.

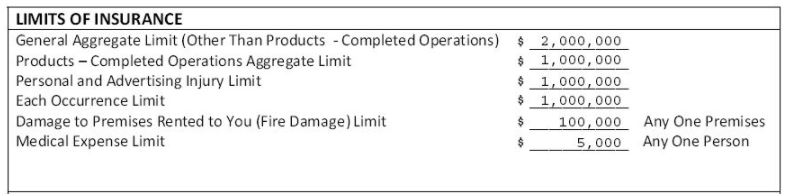

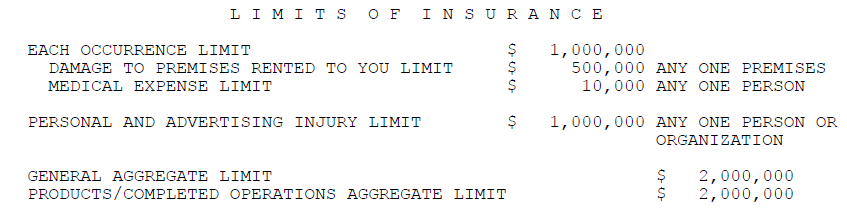

General aggregate limit insurance term. A general aggregate limit is the maximum amount of coverage an insurer will pay during a period of time, typically annually. The limit of coverage shown next to the term “general aggregate” is an annual maximum amount payable in the event of more than one claim event. The commercial general liability policy uses both a general aggregate limit and a products and completed operations aggregate.

The aggregate limit of liability is the total amount in dollars that you will be paid by your insurance policy. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Say your insurance aggregate limit is $1 million.

The general aggregate limit of an insurance policy is the maximum amount of money the insurer will pay out during a policy term. This is different than a per occurrence limit, which is the maximum amount the policy pays out per claim levied against you within the term of your policy. Because it’s a sum total, aggregate insurance can cover more than one claim.

The purpose of the limit is to. Westchester argued that the term is commonly used in policies and means the maximum that applies to all underlying insurance. 100% online or with a licensed agent.

In addition to aggregate limits, there. 100% online or with a licensed agent. The general aggregate limit liability refers to the most money that an insurer can be obligated to pay to an insured party during a specified period.

100% online or with a licensed agent. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. The general aggregate limit in your commercial insurance policy refers to the maximum amount your insurer will pay for covered liability claims during your insurance term.

It may be definitive, as in a general lifetime maximum for claims, or it may be set annually (like $500,000 per year). This may lead the company owner to believe that. The general aggregate limit in your cgl insurance is an example of that balancing act.

What is general aggregate limit of liability? Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for. In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure.

Ad affordable life insurance with no medical exam. The commercial general liability policy uses both a general aggregate limit and a products and completed operations aggregate. Once the limit is reached, the insurer will stop paying claims.

This may lead the company owner to believe that. Thus, if you’ve exhausted your general aggregate limit, your insurer is no longer responsible for covering property damage, bodily injury, medical expenses, or lawsuits. Insurance policies typically set caps on both.

A general aggregate sets the limits of your commercial general liability (cgl) policy. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Many insurance policies have what is called an aggregate limit.

General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. By setting a limit on payouts, the insurance provider can keep their cost relatively low to encourage business owners to purchase a policy. By setting a limit on payouts, the insurance provider can keep their cost relatively low to encourage business owners to purchase a policy.

As mentioned, the general aggregate limit is another term for aggregate. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. 100% online or with a licensed agent.

Say your insurance aggregate limit is $1 million. It is the payout limit for all incidents occurring during the policy period. This is typically part of commercial general liability and professional general liability insurance policies.

What does ‘general aggregate’ mean in an insurance policy? General aggregate limit insurance coverage. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term.

A small construction company may have a general liability policy with an aggregate limit of $2,000,000. By setting a limit on payouts, the insurance provider can keep their cost relatively low to encourage business owners to purchase a policy. The general aggregate limit places a ceiling on the insurer’s obligation to pay for property damage, bodily injury,.

The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims, losses, and lawsuits that happen during the active period of your policy (typically one year). An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year. Ad affordable life insurance with no medical exam.

A general aggregate limit of liability applies to all types of liability claims that the policy covers, such as property damage, bodily. The aggregate limit for covered losses resets at the beginning of the new policy term. The general aggregate limit of an insurance policy is the maximum amount of money the insurer will pay out during a policy term.

Contractual Liability And The Cgl Policy Expert Commentary Irmicom

2

Claims Made Vs Occurrence Insurance Policies - Embroker

Httpsbohoutiblogspotcom202008professional-pilot-car-insurancehtml Pilot Car Car Insurance Commercial Insurance

Whats The Difference Between Occurrence Claims-made Insurance

What Is The Difference Between Per Occurrence And Per Aggregate - Crowley Insurance Agency

What Are Aggregate Limits And Per-occurrence Limits In My General Liability Insurance Policy

Limit Of Liability - What You Should Know Insurance Dictionary By Lemonade

Newjetnetaacom Login Guide For Jet Netamerican Airlines Employee Account In 2021 American Airlines Saved Passwords Airlines

General Liability Insurance Everything You Should Know Landesblosch

The Difference Between Per Project Per Location Bcs University

General Liability Insurance Cost Insureon

Pin By Darla Kiste On Advertismentsbusiness Info In 2021 Company Benefits Trade Association General Liability

Commercial General Liability Insurance General Liability Plans

Pin By Kanteron Systems On Certificates And Awards Madrid Espana Fiscal Chart

What Are Deductibles In Health Insurance In India

Limit Of Liability - What You Should Know Insurance Dictionary By Lemonade

What Does Aggregate Mean In Insurance

Producers Guide Certificates Of Insurance In Film Wrapbook