Renters Insurance Ohio Progressive

You can now service your policy atprogressive.com please continue to register your policy. Renters insurance rates are fairly inexpensive and generally won’t vary as much as home insurance rates.

Progressive Renters Insurance Review Pros Cons Pricing And Features

This compares favorably to the state average rate of $166, offering a 55% discount on average policy costs statewide.

Renters insurance ohio progressive. The cost of renters insurance primarily depends on the value of the property being insured. Renters insurance prices in ohio by company. When you quote renters insurance with progressive, you can customize your coverage and limits.

Progressive does go a little further with coverage against mold and damages to the property it may cause from $2,500 until $50,000, as well as mold liability protection from $25,000 to. A landlord's insurance policy covers the building, but not your personal things. How much does renters insurance cost?

With american strategic insurance corp, asi assurance corp, asi preferred insurance corp, asi services inc, asi select insurance corp, and asi lloyds, which companies are affiliated with progressive. Prices for renters insurance in ohio differ depending on the insurance company you choose. The lowest average price for renters insurance we found was $11 per month, or $138 per year.

Nationwide's renters insurance coverage provides customizable protection at affordable rates. Renters insurance helps protect you and your belongings if the unexpected happens. It also protects you against a lawsuit if a guest in your home is hurt or their property is damaged.

Renters insurance provides personalized protection. Renters insurance rates are super affordable. Calculating the cost of tenants insurance in ohio.

An allstate renters policy has an average monthly premium of about $16 1. Progressive renters insurance provides the industry standard coverage. Renters insurance is an affordable way to protect your personal property against the threat of damage or theft.

See the short company reviews, best cities to rent in, and use our quick custom quote option for the cheapest renters insurance in ohio. If you’re a renter with progressive auto insurance, this might be the cheapest policy option for you. Renters policies are placed through progressive specialty insurance agency, inc.

Renters insurance policies are available from a variety of insurers, and it might be smart to bundle it with car insurance. Personal property the personal property portion of your renters insurance coverage includes repairing and replacing your personal belongings, like clothes and electronics. Renters insurance is an affordable way to cover personal belongings, and don’t forget about its liability insurance and coverage for additional living expenses.

If you also insure your car with allstate you may be able to pay as little as $4* a month. Cincinnati insurance offers the most affordable renters insurance in ohio — only $75 yearly. Get a renters insurance quote today and we'll show you how easy and affordable it is to protect what you.

64 n dixie, vandalia, oh 45377. Based on quotes from the companies in this survey, we found that the average cost of a $25,000 renters insurance policy is about $23 per month, or $276 per year — about the same cost per year as an annual credit card fee or three cups of coffee a week. Personal property is covered from $15,000 and higher, while medical liability coverage taps out at $5,000.

In 2019, the average cost of renters insurance from asi ®, one of the insurers in progressive’s network and part of our family of companies, ranged from $10 to $23 per month. Not only does renters insurance cover your belongings, it also typically includes a few types of coverages such as family liability coverage, additional living expenses, and guest. Looking for the best renters insurance in ohio?

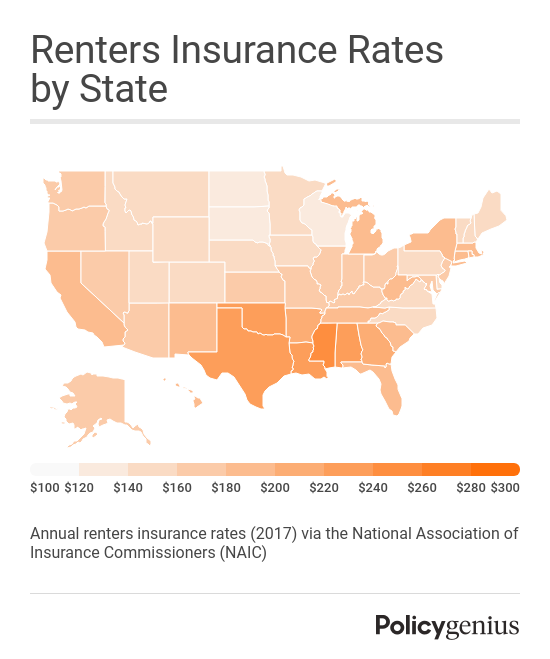

The average cost of renters insurance in ohio is $20 per month, or $237 per year, which is more expensive than the average cost in the united states — about $187 per year. In order to provide a rate estimate, we averaged personal property limits of $25,000 and $50,000 from popular companies in the u.s. It helps to protect you financially if you rent a home, apartment or condo.

Renters insurance is designed to cover unexpected events, including theft of your personal property and injuries that you are liable for to visitors. Whether you're renting your first apartment in columbus, leasing a loft in downtown toledo or living in a dayton bungalow, you need a dependable renters insurance policy. You will need to pay a deductible before your insurance coverage pays for a loss, with the average deductible around $500 or $1,000 for the average renters insurance policy.

It offers a rate comparison tool for various insurances on its. The average cost for the policy with $100,000 in liability coverage is about $27 a month or $325 a year. The average annual rate for a renters insurance policy is $188, or $15.66 per month.

Renters insurance is one of the most affordable ways to protect your belongings. We even offer renters insurance discounts to help our members save more. Get protected in your apartment,.

If you rent an apartment, condo, house, etc., you need renters insurance. Also, it is one of the cheapest insurances to buy. Even the state's most affordable renters insurance is slightly more expensive than the country's average.

It provides property insurance for homes, condos, manufactured homes, and renters, as well as personal umbrella insurance and primary and excess flood insurance. (ca lic #0f50053, tx lic #1394132) is domiciled in ohio, has its principal place of business at 6300 wilson mills road, mayfield village, ohio 44143, and does business in ca as progressive advantage insurance agency, inc. The average renters insurance policy costs between $15 and $20 per month.

Progressive Car Insurance Rates Discounts

Progressive Renters Insurance Review Pros Cons Pricing And Features

Progressive - Beranda Facebook

Progressive Insurance Review 2021 Ratings Cost And Complaints

How To Cancel Progressive Insurance 7 Steps With Pictures

Progressive Car Insurance Quote Online

Proof Of Renters Insurance Meaning Ideas Link Pico

Progressive Insurance 800 776-4737 Email Phone Number Headquarters

How Much Is Renters Insurance Average Renters Insurance Cost 2021

Farmers Renters Insurance Login In 2021 Renters Insurance Progressive Insurance Farmers Renters Insurance

Corporate Locations Campus 1 In Mayfield Village Ohio Progressive

Progressive Renters Insurance Review Pros Cons Pricing And Features

How To Cancel Progressive Insurance 7 Steps With Pictures

Progressive Renters Insurance Review - Renters Insurance Comparison

Progressive Home Advantage Roger Smith Insurance Agency

Progressive Renters Insurance Review Pros Cons Pricing And Features

Renters Insurance Georgia Progressive - Insurance

Progressive Insurance Az Rightsure 520-917-5295 Progressive Insurance Insurance Agent Progress

How To Cancel Progressive Insurance 7 Steps With Pictures