Dependent Life Insurance Meaning

For eligible children, the amount of A beneficiary can be a person or a legal entity that is designated by you to receive a benefit, such as life insurance.

Guide To Buying Life Insurance For Parents - Elderly Burial

Dependent is a person who is eligible to be covered by you under these plans.

Dependent life insurance meaning. A dependent may be a spouse or child. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. This may not seem like a significant problem, but certain health conditions could make it difficult to find an affordable policy, or even make it impossible to qualify for coverage.

This type of insurance commonly covers funeral expenses and other costs from. It will cover a spouse who is dependent on the policyholder and will cover children. The amount of additional life insurance is from one to ten times your basic annual pay rounded up to the next whole thousand dollars as elected under beneflex.

Finally, many voluntary life insurance policies will contain provisions for accidental death and dismemberment, also known as voluntary ad&d. A spouse who is not legally separated from the policy holder The individual or individuals may be desigated as a dependent for medical insurance, a dependent for dental insurance and a beneficary for death benefits, but the selections are separate and must be made for each.

When your children are first eligible, at your date of hire or when you first acquire your child if later, you may elect dependent life insurance for your eligible children in increments of $5,000 up to a maximum of $20,000 without. If a covered dependent dies, you would receive the dependent life insurance policy's face value as the death benefit, as the employee is automatically designated as the beneficiary. You will be required to submit medical evidence for all amounts of optional life and can apply for amounts up to the overall life insurance maximum.

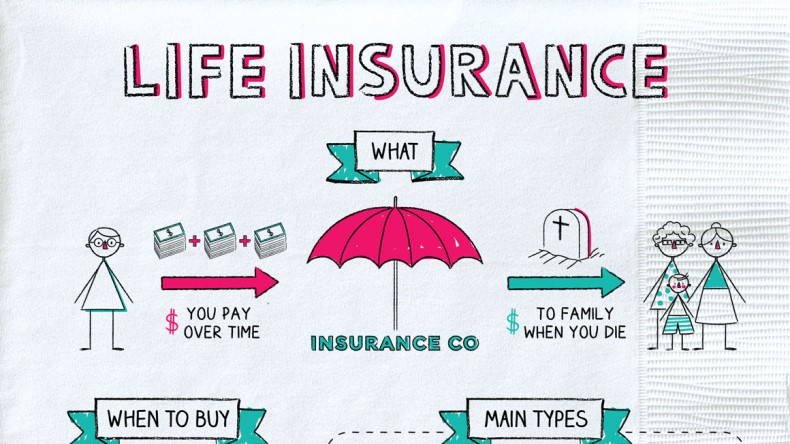

Dependent life insurance provides coverage in the event a spouse or dependent child dies. Dependant life insurance dependent life. Affordable, flexible term life insurance at your pace.

The policy holder typically pays a premium, either regularly or as one lump sum. Affordable, flexible term life insurance at your pace. That means you may need to reapply for new coverage (either at your new job or independently from a life insurance company) based on your current age and health status.

Dependent insurance can cover your spouse, children and any other eligible dependents, depending upon the rules laid out in the plan. Dependent life insurance offers a payment, known as a death benefit, in the event a covered spouse or child dies. A spouse or domestic partner (even if your spouse or domestic partner purchases dependent coverage for you under this same plan) an unmarried biological or adopted child or stepchild from age 15 days to age 26 (whether or not the child is a student)

Dependent life insurance is a type of insurance that pays out a death benefit when one of your dependents passes away. Coverage for the spouse is generally higher than that available for children. An eligible dependent is a person who is financially dependent on an insurance policyholder.annual open enrollment period :basic life coverage is included with all system health plans.dependent child and spouse/domestic partner life and ad&d insurance.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Designating dependents under medical and/or dental insurance has no connection to designating beneficaries. Group term life insurance covering an employee?s dependent.

The dependent life insurance amount for your spouse is $25,000. Most of the time, they must also live with the policyholder. However, sometimes, a parent can be claimed as a dependent for health insurance purposes as proves.

Generally speaking, dependents are children or family members that depend upon the health insurance policyholder for financial support. The maximum amount of additional life insurance is $1,500,000. This coverage is separate from your mit basic life insurance.

This form of coverage for your dependents is known as dependent group life insurance, which may help with funeral costs and other related expenses if your spouse or child unexpectedly dies. Dependent life policies may cover: Optional life insurance (optional life) provides additional protection and insurance to employees and eligible dependents by increasing the amounts paid as part of existing life or dependent life insurance policies.

Available only to the spouse and dependent children of an employee, dependent life plans provide coverage in flat amounts only. Health insurance covers between rs.

What Is Life Insurance And How Does It Work Money

Pin On Insurance

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Pin On Medschool- Nursing Notes

Examples Of Financial Goals By Age Groups Life Goals Quotes Financial Goals Goals

How Does Whole Life Insurance Work Costs Types Faqs

Member Level Rating - Individual And Small Group Family Premium Calculation Small Groups Health Care Reform Individuality

What Is Dependent Life Insurance Coverage For Non-income Earners

How Much Life Insurance Is Enough Life Insurance Life Insurance

43 Of Those Age 25-44 Are Concerned With Leaving Dependents In A Difficult F Life Insurance Awareness Month Life Insurance Marketing Life And Health Insurance

Human Systems Social App Design App Design Process Social App

Economics Of Life Insurance Coverage Insurance Mutual Insurance Insurance Coverage

Pin On Life Insurance And Investments

What Are The Different Types Of Life Insurance We Have The Answer

Where Can You Find Life Insurance Rates By Age Life Insurance Quotes Term Life Insurance Quotes State Farm Life Insurance

What Is Life Insurance Exact Definition Meaning Of Life Insurance

A Hug Means I Need You Need A Hug Quotes Hugs Meaning Hug Quotes

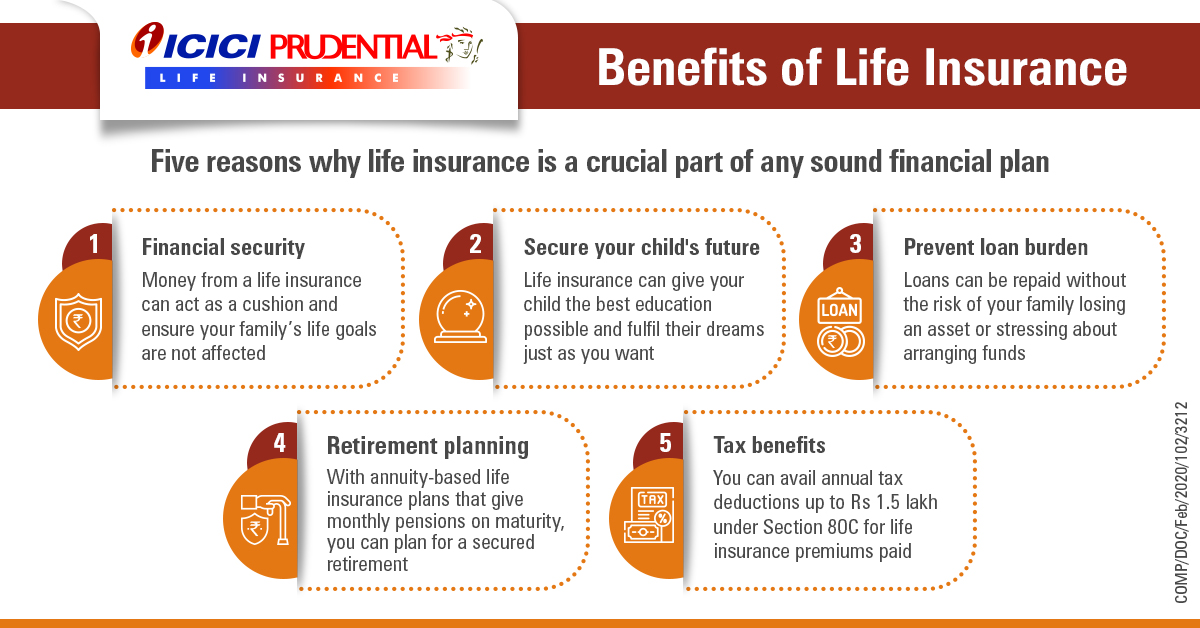

Benefits Of Life Insurance - Need For Life Insurance Icici Prulife

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons