Shenandoah Life Insurance Company Medicare Supplement

Medicare part a coinsurance payments up to an additional 365 days after original medicare benefits are exhausted;. Compare all medicare supplement insurance plans (medigap) plans offered by shenandoah life insurance company in virginia.

Sell Shenandoah Life Insurance Company Medicare Supplement Insurance New Horizons

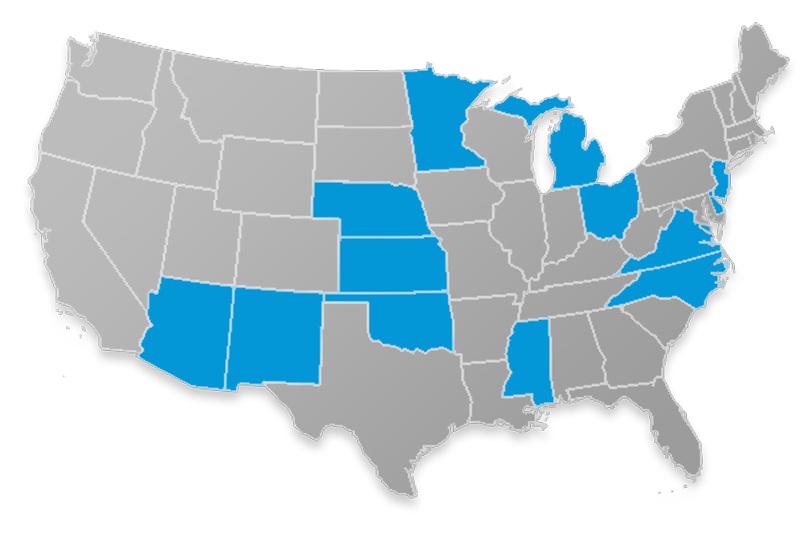

Shenandoah life insurance company offers this plan in all states where they sell supplemental insurance (see above).

Shenandoah life insurance company medicare supplement. And s.usa life insurance company, inc., is a leading provider of protection, supplemental and asset accumulation products distributed through banks, independent marketing organizations,. Shenandoah life is a member company of the prosperity life group and has been in the insurance business for 90 years. A medicare supplement from shenandoah life will help you with the copayments, coinsurance, and deductibles, making your costs more manageable.

This medigap plan will help you pay your portion of the costs of your medicare part a and medicare part b benefits. Unlike plan f and plan g, with a medicare supplement plan n policy, you'll make a copayment of up to $20 for some doctor visits and up to $50 for emergency room care that does not require you to be admitted into the. However, it only covers one person, so if you are married, your spouse is recommended to purchase a separate policy.

The panel above briefly outlines the coverage. Shenandoah life insurance company affiliates sbli usa life insurance company and s.usa life insurance company, inc., members of the prosperity life group, are launching new medicare supplement pans. Shenandoah life offers a variety of medicare supplement insurance.

It covers doctor visits, preventative care, tests, durable medical equipment, and supplies. They are an innovative life insurance company with ageless values designed for the next century. Shenandoah life insurance company offers it some areas (see above) because it helps seniors fill the gaps in their original medicare benefits in a unique way.

Shenandoah life insurance company helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. Compare all medicare supplement insurance plans (medigap) plans offered by shenandoah life insurance company in new jersey. Shenandoah life insurance company and their licensed agents are not in any manner affiliated with or sponsored by the federal government, the social security administration, the centers for medicare and medicaid services, or the department of health and human services.

Shenandoah medicare supplement will be discontinued effective october 1, 2021. Shenandoah life offers 8 different lettered plans, each with its own pros and cons. Worry less about the future with term life insurance.

In addition, it’s important to note that shenandoah medicare supplement policies are guaranteed renewable each year. Not all prosperity life products are available in all states, so it’s best to check with the firm’s. Compare shenandoah life medicare supplement plan c with other medigap plans.

Get free advice and help from a licensed insurance agent to enroll in the plan of your choice. Shenandoah life is a new star rising, helping to ensure a better tomorrow. Shenandoah life insurance company administrative office:

Shenandoah life is breaking barriers by creating unique, dynamic insurance products that address the challenges of today's families and individuals. Get free advice and help from a licensed insurance agent to enroll in the plan of your choice. Here's how shenandoah life's plan a helps with your costs:

Ad don’t delay on getting term life insurance. Worry less about the future with term life insurance. Members not licensed in all states.

Prosperity, through its member companies, shenandoah life insurance company , sbli usa life insurance company, inc. Shenandoah life medicare supplements are available to all texas beneficiaries, ages 65 and older, who are enrolled in medicare part b medicare part b is medical coverage for people with original medicare benefits. Medicare supplement plan g covers your share of any medical benefit that original medicare covers, except for the outpatient deductible.

It covers doctor visits, preventative care, tests, durable medical equipment, and supplies. If you are shopping for a medicare supplement plan c, shenandoah life is one option. Prosperity life group℠ is a marketing name for products and services provided by one or more of the member companies of prosperity life insurance group, llc, including sbli usa life insurance company, inc., s.usa life insurance company, inc., and shenandoah life insurance company.

Ad don’t delay on getting term life insurance. Medicare supplement plan a offers the least coverage of all supplements. Shenandoah life medicare supplements are available to all illinois beneficiaries, ages 65 and older, who are enrolled in medicare part b medicare part b is medical coverage for people with original medicare benefits.

Shenandoah Life Medicare Supplement Plans L A Full Review

Smsteamnet

Shenandoah Life Prepares To Resume Sales Business News Roanokecom

All Product And Training Information Contained In This Presentation Is Intended For Agent Use Only This Piece Is Not Intended To Create Public Interest - Ppt Download

Shenandoah Life Insurance Company Prosperity

2

Shenandoah Life Insurance Co Is Rebuilding Its Foundation Business News Roanokecom

Shenandoah Life Insurance Company Prosperity

2

Shenandoah Life Medicare Supplement

About Prosperity

Shenandoah Life Medicare Supplement - Tidewater Management Group

2

Shenandoah Life Insurance Company Company Profile Acquisition Investors Pitchbook

Shenandoah Life Medicare Supplement

Shenandoah Life Medicare Supplement - Tidewater Management Group

Smsteamnet

Smsteamnet

2