Cheap Fr44 Insurance Virginia

The cost of fr44 insurance is determined by your state’s minimum liability requirements. Compare car insurance companies for free to get the cheapest insurance quotes and coverage.

Cheapest Virginia Sr22 Insurance - Filed In Under 5 Minutes

Ad 2022 insurance are available.

Cheap fr44 insurance virginia. If you own a motorcycle and need to file a virginia fr44 insurance certificate, you can obtain virginia fr44 motorcycle insurance. Our agents will shop through our arsenal of carriers to find you the best rates; Old wife in northern va;

The fr44 insurance minimum in virginia is $25,000 for injury to one person, $50,000 for injury to two or more people, and $20,000 for property damage. Find the best auto insurance in virginia: Get the best quote and save 30% today!

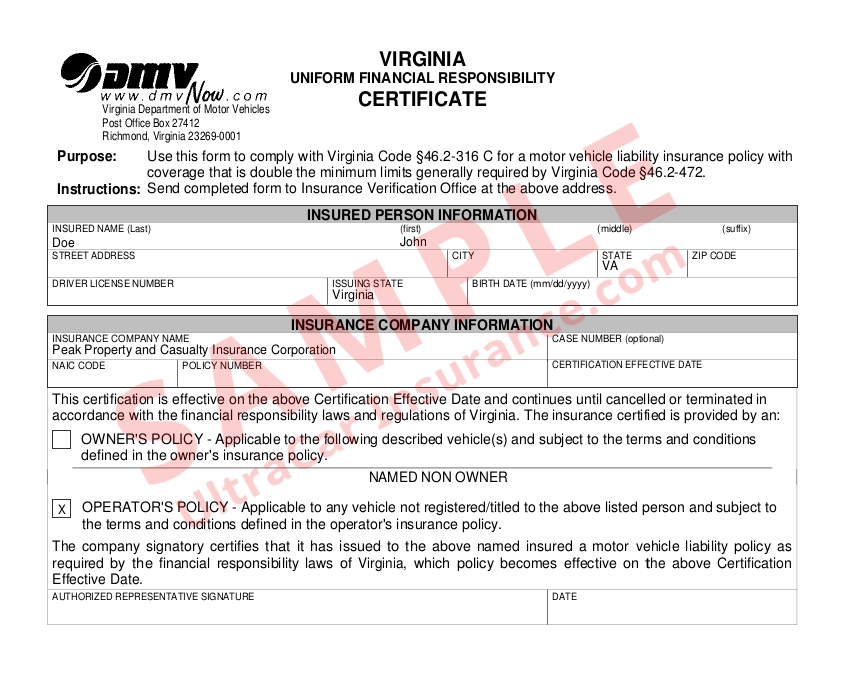

Find the top rated 2022 plans & save! An fr44 certificate must be filed for license reinstatement after a dui in virginia.an fr44 is a financial responsibility. Ultracar insurance can endorse your fr44 certificate to a motorcycle insurance policy.

All resident drivers need to carry cheap fr44 auto insurance florida certificate for 3 years after reinstatement suspended driver’s license post dui or dwi conviction. Ad compare top expat health insurance in indonesia. Select insurance group has been in the fr44 insurance industry for over a decade and can help you obtain a cheap fr44 insurance price simply because we are not tied down to one particular company.

How much does fr44 virginia cost? Insurance requirements for car insurance for dui cases are the most stringent in the whole country, with only virginia having a similar law. Depending on the type of conviction you may be required to file an sr22 or fr44 with the department of motor vehicles.

This form is added to an auto insurance policy and normally costs $20 to $45 depending on the insurance company you choose. Don't overpay for sr22 insurance in va. Virginia fr44 insurance has higher premiums and higher coverage requirements than virginia sr22 insurance.

Coverage starting at midnight, care as soon as tomorrow. Virginia is one of only two states that have fr44 filings (florida being the other). Let us help you save $100's on virginia sr22 auto insurance.

The fr44 is a drunk driver insurance policy meant for drivers who have been convicted of a dui to regain their license, registration, and tag. Florida & virginia require fr44. Get the best quote and save 30% today!

The sr22 (safety responsibility) filing indicates that you have at least the minimum liability limits for the state of virginia which is bodily injury at $25,000 per. Husband has dui and fr44 filing. To reinstate your license after a dui in florida or a dwi in virginia, you will need to file an fr44 certificate with the dmv.

Many times resulting in companies competing for your business. When do i need an sr22 in virginia? The liability insurance requirements for fr44 coverage are 50/100/40:

$50,000 bodily injury per person; To put it nicely, when it comes to auto insurance, virginia is very hard on dui's compared to most states. Car insurance for all drivers by phone.

An fr44 certificate is required by the court to verify you have double your state’s minimum liability requirements. Drivers, who have been convicted for either dui or dwi offenses, are needed to carry virginia fr44 certificate for a period of 3 years from the date of suspension of their driver’s license. If your insurance cancels, your fr44 will become invalid and your license will be suspended.

Coverage starting at midnight, care as soon as tomorrow. Here’s how to get one — and how to keep your rates as cheap as possible. Give us a call, or click below to fill out our short quote request form, and start saving today.

Find the top rated 2022 plans & save! We work with several insurance companies to try and get you the very best rate for all situations. That’s $349 more than the annual average cost for a standard policy for a driver with a clean record of $423.

When it comes to the commonwealth of virginia, requiring an fr44 insurance filing as a result of getting a dui is very expensive. It only takes less than 5 minutes to save $100's. Liability on 2004 toyota camry.

$100,000 bodily injury per accident; We issued policy and fr44 filing same day! Ad compare top expat health insurance in indonesia.

Sr22 & fr44 virginia non owners insurance is needed to reinstate your suspended driver’s license if you do not own a vehicle or have regular use of one. Ad 2022 insurance are available. Cheap auto insurance sr22 fr44 all drivers affordable car insurance.

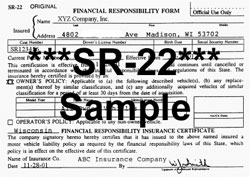

The Difference Between An Sr22 And Fr44

Hayes 4 Insurancecom - Virginia Auto Insurance For Va Residents And Businesses Low Cost Va Car Insurance Quote

What Is Fr-44 Insurance And How Is It Different From Sr-22

Florida Fr44 Insurance - Cheapest Florida Fr44 Insurance

What Is Fr44 Virginia Low Rates On Fr44 Dui Insurance

Best Cheap Sr-22 And Fr-44 Insurance In Virginia - Valuepenguin

Sr22 Insurance Virginia The Cheapest Only 7month

Fr44 Insurance Virginia Va

Fr-44 Vs Sr-22 In Virginia Car Insurance

Example-virginia Fr44 Certificate Ultracar Insurance

How Long Do I Need To Keep A Virginia Fr44 Select Insurance

Virginia Fr44 Insurance Filing Requirements And Buying Guide - Lyles Insurance

What Is Fr44 Insurance What Is The Purpose Of Fr44 Insurance

Commentary Gallery Blog About Anything

Best Cheap Sr-22 And Fr-44 Insurance In Virginia - Valuepenguin

Sr-22 Fr-44 Auto Insurance Brandenton Palmetto St Petersburg

Sr-22 Insurance Compare Quotes And Find Cheap Coverage - Valuepenguin

Fr44 Form - Fill Online Printable Fillable Blank Pdffiller

Commentary Gallery Blog About Anything