How To Avoid Cobra Insurance

When you sign up for cobra insurance always make a note of any special requirements your policy may have for cancellation as many times, you will have to notify your previous employer in writing. Another point of confusion is how cobra is administered during a company merger or acquisition.

Guide To Cobra Health Insurance How Does Cobra Insurance Work

Treating employees on cobra differently from similarly situated employees who aren’t on cobra.

How to avoid cobra insurance. Failing to offer cobra when required. Reasons to not pay for cobra. If applicable, you can contact the human.

Go to how long can i keep my cobra insurance page via official link below. If you haven’t received your cobra paperwork, it’s advised to contact the employer from where the insurance was from. If you cannot then you should either pay the cobra money or (what i would do) look into an individual plan.

If you still can’t access how long can i keep my cobra insurance please leave a message below. There are penalties for businesses that do not comply with the law. Paying for cobra insurance and how to avoid penalties [part 4] the olson group.

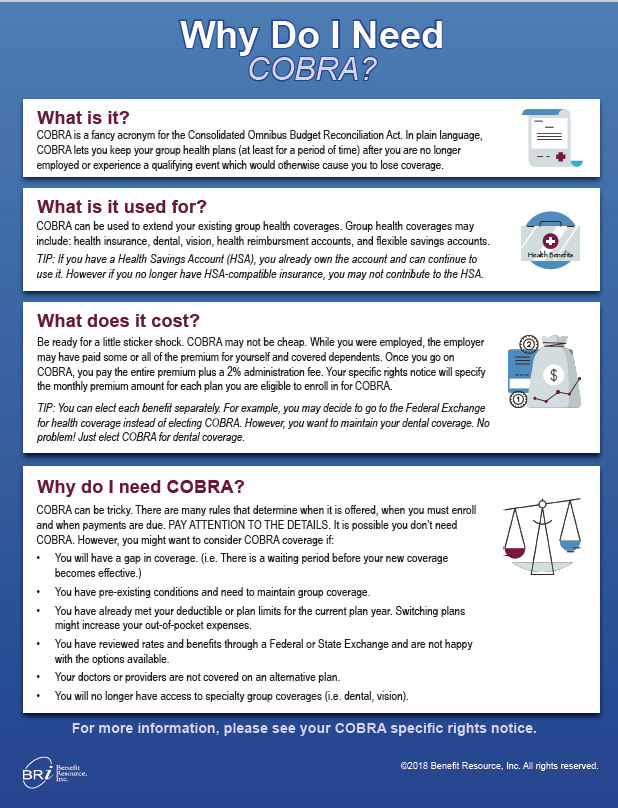

According to the consolidated omnibus budget reconciliation act of 1985 (cobra), companies with 20 or more employees are required to allow workers to keep their health insurance coverage, if that coverage would end due to a qualifying event. I called doa member services and spoke to someone who said that a letter with proof of my new insurance would be sufficient to cancel cobra coverage and receive a refund for the amount that was applied to my account after my effective cancellation date. If you decide to keep cobra without premium assistance, you can qualify for a special enrollment period based on the end date of your cobra coverage, which is usually 18 to 36 months after it started.

If you decline your new employer’s health plan, you have to wait until the open enrollment period to get onto the new employer’s group health plan. Per the law if you short pay by $50.00 or less or 10% or less cobra needs to give you thirty days to pay them the difference. Write a letter to the plan administrator of your previous health insurance to advise him of your intent to discontinue your cobra benefits.

How can i avoid paying cobra? To cancel your your cobra coverage you will need to notify your previous employer or the plan administrator in writing. You’ll want to ask for the companies cobra administrator.

Cobra requires employers to keep you on their insurance for as long as you need it, or for the maximum time frame. There are some factors you should keep in mind when thinking about whether or not to use cobra. The consolidated omnibus budget reconciliation act (cobra) requires that employers provide former employees and dependents who lose group health benefits with an opportunity to continue group health insurance coverage for a limited period of time.

If you think you can make it then move on to the next step. The check for my refunded balance can be mailed to: Cobra coverage will handle the interim on my old employers policy.

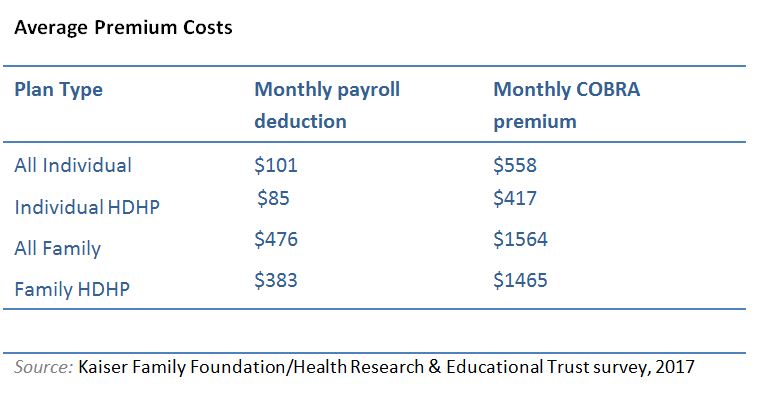

After you stop your cobra insurance, your former employer should send you a letter affirming termination of that health insurance. And one of these factors is the cost. Failing to provide required notices (or sending them late) to the employee and other qualified beneficiaries.

How to avoid losing your cobra insurance. In parts one, two, and three of our cobra articles, we’ve broken down what cobra is. Find the official insurance at the bottom of the website.

Premium payment is required during the first 45 days after an election is made or the coverage is cancelled retroactively. If you are using cobra health insurance and no longer need it, you can cancel it. If you see multiple doctors and they don’t take the new employer’s plan but accept the cobra plan, you may find it makes sense to pay more for cobra coverage and keep the same provider network.

If you have questions about cobra or cobra premium assistance, visit the u.s. I lost my cobra insurance january of this month because i had moved and didn’t receive the notice that my premium had gone up $26.00 which was slightly more than a 10% increase. But cobra does not mandate that they pay for it.

And while normally you can only enroll in a marketplace plan during the annual open enrollment period (oep), losing your job is a qualifying life event that will make you eligible for a special. Login to your online portal at mybenefits.wageworks.com and complete a message center request and submit an online support request with cancelation details. You may cancel cobra at any time.

There are a number of issues to consider, including what type of acquisition, sale or merger a business goes through, and the employee’s status as a result of. If you can make it the remaining time without coverage and stay healthy then the. If someone in my family breaks a few bones or has some other expensive medical problem, i will most likely pay the premiums, but if the insurance is unused, i want to avoid.

Apr 26, 2019 · 5 min read. Compliance with the complex rules regarding cobra coverage can be difficult and mistakes can be. Typically, this is someone in the hr department.

Top 10 Cobra Mistakes - Clark-mortenson Insurance

Top 10 Cobra Mistakes - Clark-mortenson Insurance

I Lost My Health Insurance Now What

Cobra Insurance Guide What Is It How Does It Work - Aetna How Much Does It Cost How Long Does It Last More Questions

How Cobra And Medicare Interact For Retirees - Newfront Insurance And Financial Services

What Is Cobra Insurance How Does It Works Insurancecom

Cobra Health Insurance What Is It Should You Use It

Dol And Irs Issue Covid-19 Benefit Plan Rules Cobra Deadline Extensions And Updated Model Cobra Forms - Frost Brown Todd Full-service Law Firm

Guide To Cobra Health Insurance How Does Cobra Insurance Work

Top Three Reasons To Pay Attention To Cobra In 2021 - Optum Financial

Arpa Cobra Subsidies For State Continuation Coverage Sequoia

Six Reasons To Consider Cobra Coverage - Bri Benefit Resource

What Is Cobra Insurance How Does It Works Insurancecom

10 Cobra Mistakes Health Savings Associates

6 Reasons Cobra Coverage Ends Early - Bri Benefit Resource

Cobra Administration For Dummies Your Guide To Cobra Compliance

Pros And Cons Of Most Common Health Insurance Plans Health Insurance Plans High Deductible Health Plan Health Insurance

Do You Still Need Cobra Health Coverage - Healthinsuranceorg

What Is Cobra Insurance Coverage Cost And Affordable Alternatives