Contract Of Adhesion Insurance Def

Insurance contracts are the most common form of aleatory contract. Practice of life insurance 20 2.0 introduction documents are necessary to evidence the existence of a contract.

Pdf The Effects Of The International Contract For Sale Of Goods

The applicant states that he applied for $15,000 coverage from xyz co., but fails to mention the $150,000 coverage with def co.

Contract of adhesion insurance def. A contract (often a signed form) so imbalanced in favor of one party over the other that there is a strong implication it was not freely bargained. Treaty reinsurance — a form of reinsurance in which the ceding company makes an agreement to cede certain classes of business to a reinsurer. Steady or firm attachment :

The adhesion insurance definition is an example of a type of adhesion contract. The major documents in vogue in life insurance are premium receipt, insurance policy, endorsements etc. 2 contract law quiz (examfx) a life insurance application is asking if the applicant has applied for any other life insurance within the past 6 months.

The most common type of aleatory contract is an insurance policy in which an insured pays a premium in exchange for an insurance company's promise to pay damages up to the face amount of the policy in the event that one's. The contract must relate to an essential product or service indispensable to consumers who cannot obtain the essential product or service except by acquiescing to the terms of the contract; Adhesion contract (contract of adhesion) n.

The other party involved only has the right to refuse any terms listed in the contract and has no ability to. Because of this, it is always possible that an insurer may never have to pay policyholders any money whatsoever. Adhesion contracts are also frequently called standard form contracts or.

For example, if a person buys a. It has been said that life insurance contracts are contracts of 'adhesion.' An insurance policy is known as.

Adhesion insurance contract is a contract where one party states the provisions of the contract while the other party is not involved in its drafting, but whose participation is in either agreeing with it or declining it. A mutual agreement between two parties in which the performance of the contractual obligations of one or both parties depends upon a fortuitous event. A rich landlord dealing with a poor tenant who has no choice and must accept all terms of a lease, no matter how restr.

The adhesion insurance definition is an example of a type of adhesion contract. The reinsurer, in turn, agrees to accept all business qualifying under the agreement, known as the treaty. under a reinsurance treaty, the ceding company is assured that all of its risks falling within the. This type of contract is drawn up between two parties, and all terms and conditions are provided by the party with the greater bargaining power or capabilities.

In life insurance several documents are in vogue. An adhesion contract (also called a standard form contract or a boilerplate contract) is a contract drafted by one party (usually a business with stronger bargaining power) and signed by another party (usually one with weaker bargaining power,. Since insurers do not usually have to pay policyholders until a claim is filed, most insurance contracts are aleatory contracts.

The abnormal union of separate tissue surfaces by new fibrous tissue resulting. Insurance policies are contracts of adhesion and, as such, are construed strictly against the party writing them (i. Adhesion contract n.(contract of adhesion) a contract (often a signed form) so imbalanced in favor of one party over the other that there is a strong implication it was not freely bargained.

Contract of adhesion — a contract offered intact to one party by another under circumstances requiring the second party to accept or reject the contract in total without having the opportunity to bargain over the wording. An adhesion contract is an imbalanced contract where one of the parties has all of the power. An annuity contract is an agreement between an individual investor and an insurance company whereby the investor pays a lump sum or a.

One of the parties retains a monopoly over the product or service or faces limited competition in supplying the product or service; Implies inequality in bargaining power The applicant is guilty of:

The documents stand as a proof of the contract between the insurer and the insured. The action or state of adhering.

Contract Of Adhesion - How To Discuss

Unilateral Contract Insurance Jobs Ecityworks

Vendor Contract Templates 5 Free Printable Legal Samples Contract Template Contract Positive Behavior Intervention

Httpsbohootblogspotcom202102pdfhtml In 2021 Contract Agreement Words Pdf

Unilateral Contract Insurance Jobs Ecityworks

Chapter 8 Insurance Contracts - Ppt Download

Insurance Law Terms You Need To Understand Concepts You Need To Master - Pdf Free Download

Insurance Law Terms You Need To Understand Concepts You Need To Master - Pdf Free Download

Chapter 8 Insurance Contracts - Ppt Download

Chapter 8 Insurance Contracts - Ppt Download

Pdf The Economics Of Standard Form Contracts

Pdf Smart Contracts In Insurance A Law And Futurology Perspective

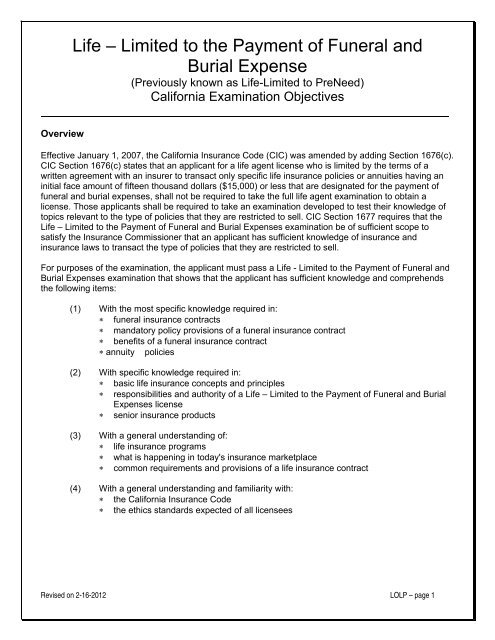

Life Limited To The Payment Of Funeral And Burial Expense

Employment Contractdefinition What To Include Contract Template Employment Policy Template

Insurance Law Terms You Need To Understand Concepts You Need To Master - Pdf Free Download

Httpsbohootblogspotcom202102safe-driving-agreementhtml In 2021 Drive Safe Agreement Driving

2

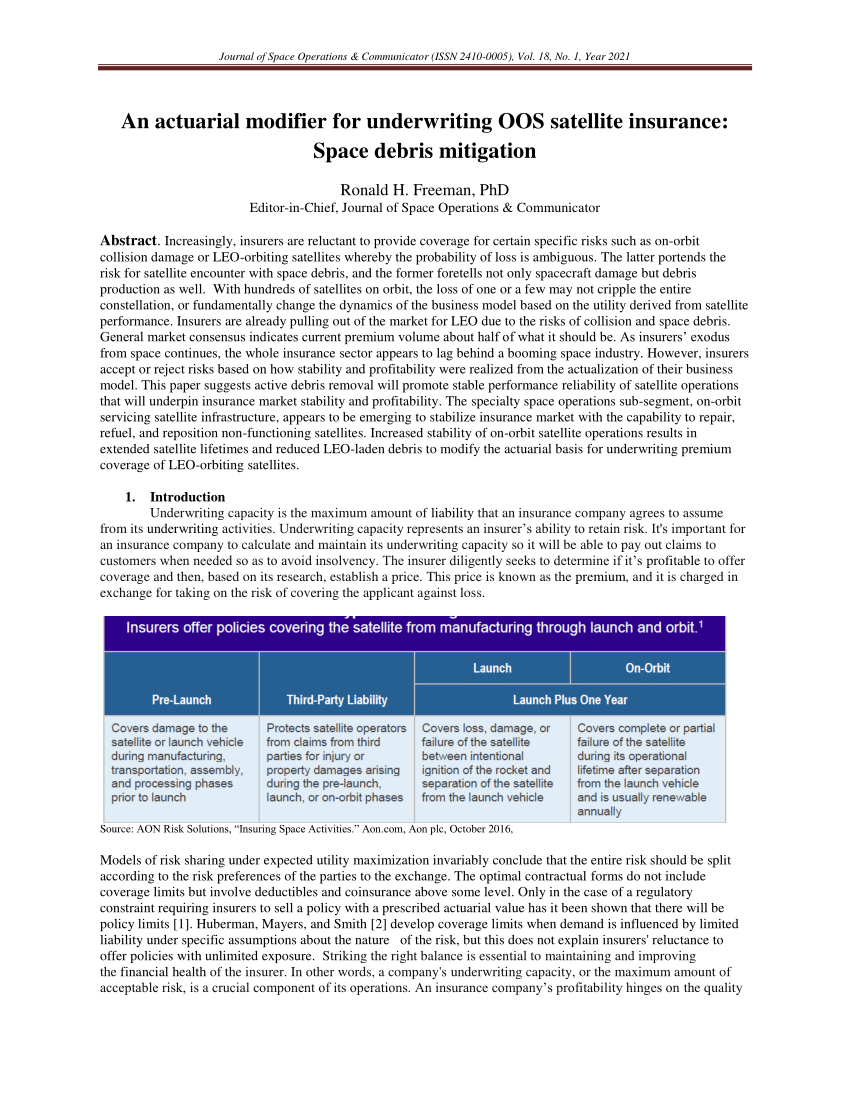

Pdf An Actuarial Modifier For Underwriting Oos Satellite Insurance Space Debris Mitigation

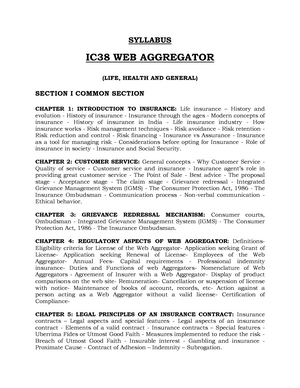

Web Aggregator Syllabus - Corporate Law - Psyc 201 - The Oxford - Studocu