Expense Ratio Insurance Term

Expense ratio shows what percentage of sales is an individual expense or a group of expenses. There are two methodologies to measure the expense ratio;

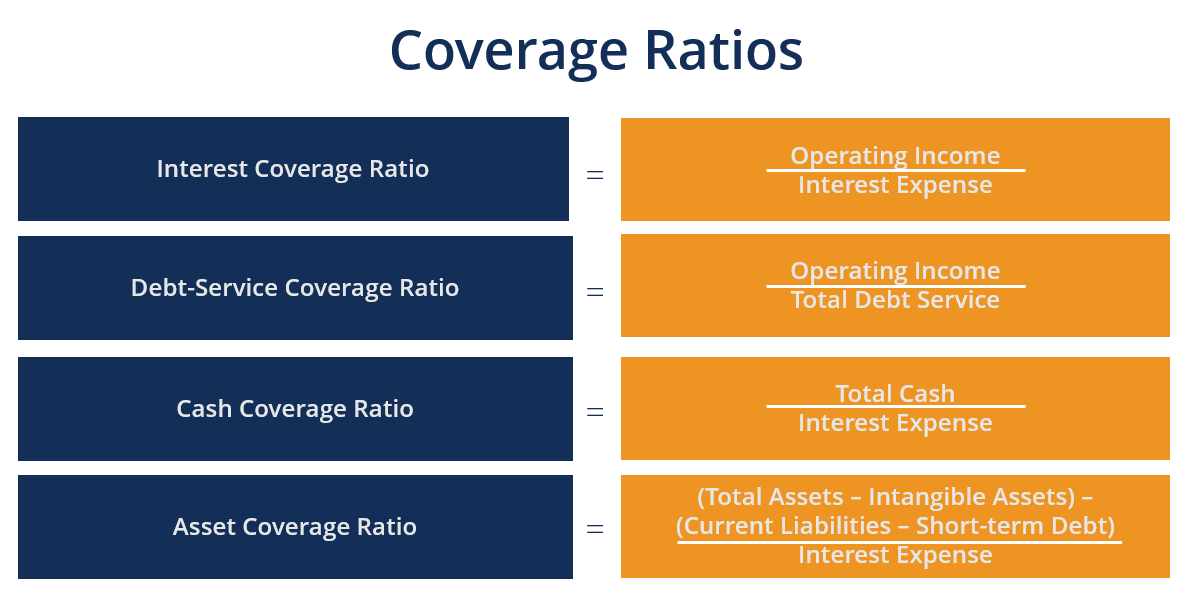

Coverage Ratio - Guide To Understanding All The Coverage Ratios

Insurance companies typically follow two methods for measuring their expense ratios:

Expense ratio insurance term. Expense ratios at 30.2% and average combined ratios at 97.5%. A lower ratio means more profitability and a higher ratio means less profitability. Net loss ratio underwriting expense ratio net u/w combined ratio combined ratio loss ratio expense ratio we have not included 31 december 2002 data as apra has not published statistics for this period.

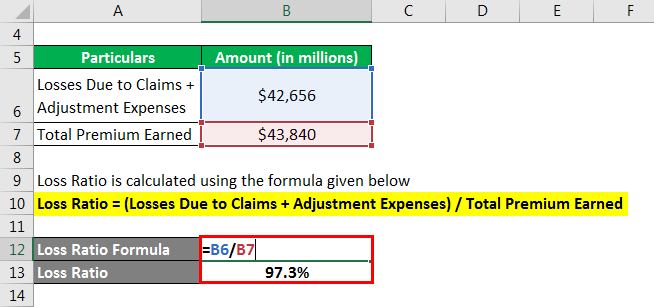

Calculated by dividing the company's capital by the minimum amount of capital regulatory authorities have deemed necessary to support the insurance operations. The claim settlement ratio (or claims acceptance ratio or claims ratio) of the insurance company = 973/1000 = 97.3%. Expense ratio reflects the efficiency of insurance operations.

One who negotiates contracts of insurance or reinsurance on behalf of an insured party, receiving a commission from the insurer or reinsurer for placement and other services rendered. Experience the loss record of an insured or of a class of coverage; Simply add the two together.

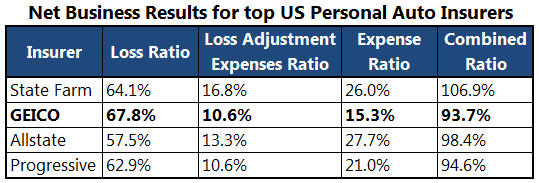

In the same time period, the 100 largest us personal line insurers grew their net written premiums at 6.1% cagr, with average expense ratios at 24.9.% and average combined ratios at 100.7%. Ad affordable, flexible term life insurance at your pace. Expense ratio refers to the percentage of premium that insurance companies use for paying all the costs of acquiring, writing and servicing insurance, and reinsurance.

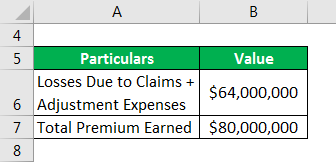

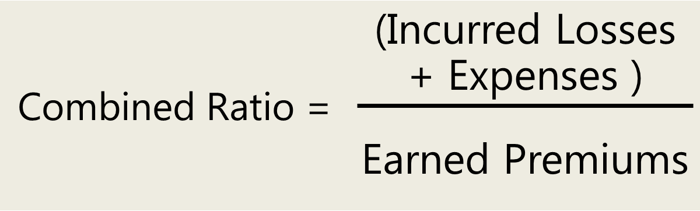

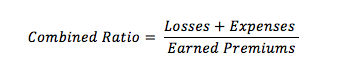

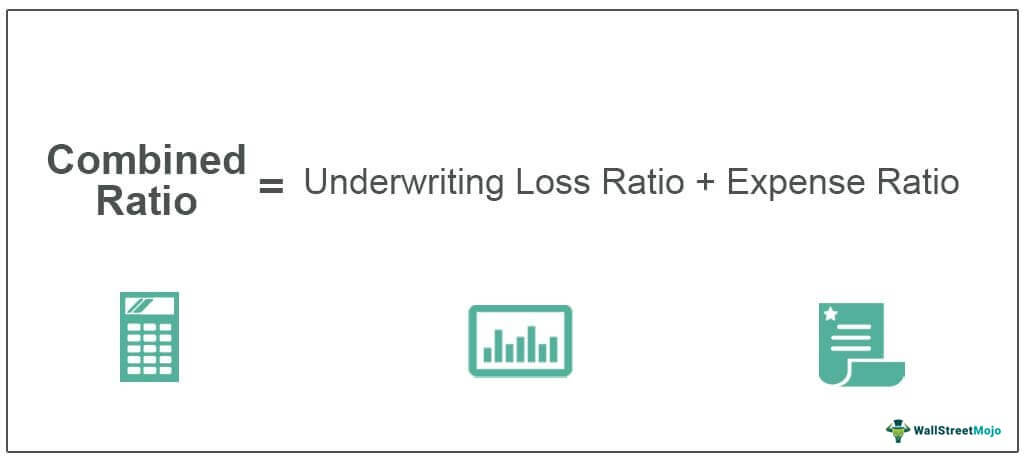

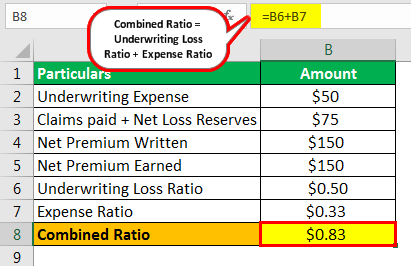

Taking the expense ratio and loss ratio, it's a simple step to calculate the combined operating ratio (or 'combined ratio'); Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer The portion of premium used to pay all the cost of acquiring, writing and servicing a policy of insurance.

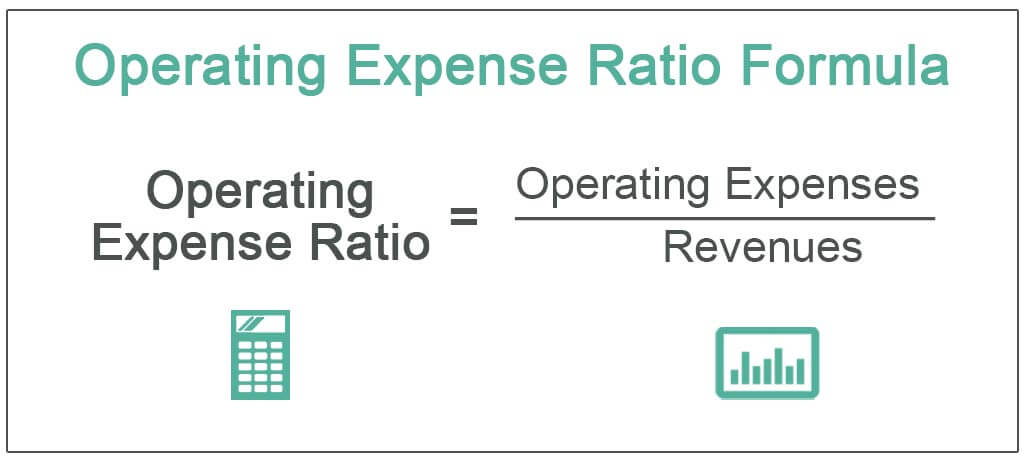

In contrast with an agent, the broker's primary responsibility is with the insurance buyer not the insurance carrier. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on underwriting expenses. Expense ratio (operating ratio) the ratio of expenses incurred expressed as a percentage of written premium;

It is measured for all products of the company put together (not term insurance plans alone). Some expenses vary with the change in sales (i.e variable expenses). The underwriting expense ratio is a mathematical calculation used to gauge an insurance company's underwriting success.

There has been a gradual decline in the acquisition cost ratio over the past three years with a corresponding increase in the administrative expense ratio. For 2002, only june data is available. Think of the expense ratio as the management fee paid to the fund company for the benefit of owning the fund.

Expense ratio — the percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance. To explain this, if an insurance company received 1000 death claims between apr 1, 2019 and mar 31, 2020, out of which it. Analyst must be careful while interpreting expense to sales ratio.

A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. Ad affordable, flexible term life insurance at your pace. The combined ratio is arguably the most important of these three ratios because.

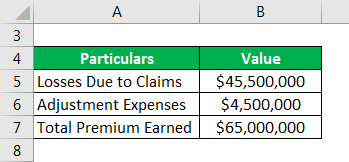

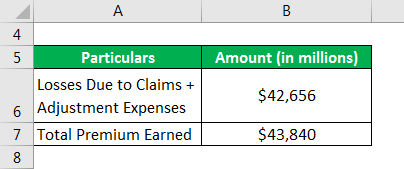

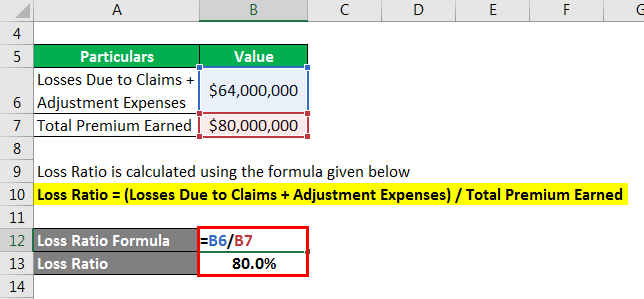

Loss Ratio Formula Calculator Example With Excel Template

Loss Ratio Formula Calculator Example With Excel Template

Insurance Industry Basics Combined Ratio The Motley Fool

Loss Ratio Formula Calculator Example With Excel Template

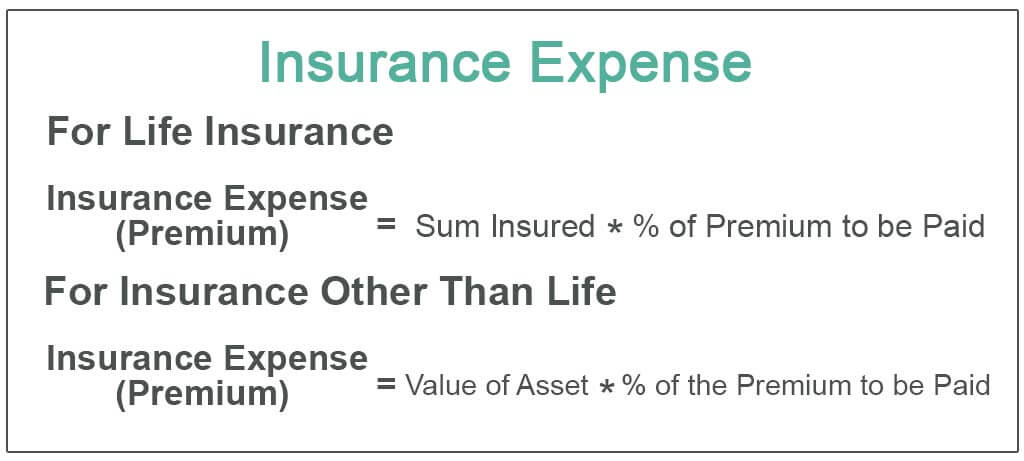

Insurance Expense Formula Examples Calculate Insurance Expense

Loss Ratio Formula Calculator Example With Excel Template

What Is Combined Ratio The Motley Fool

Loss Ratio - Overview Formula Purpose And Interpretation

Combined Ratio In Insurance Definition Formula Calculation

Loss Ratio Formula Calculator Example With Excel Template

/GettyImages-1055247044-11273b0978844d7c96980190d0951498.jpg)

What Is The Expense Ratio In The Insurance Industry

Operating Expense Ratio Formula Calculator With Excel Template

Expense Ratio What Is It Why You Should Know About It

Combined Ratio In Insurance Definition Formula Calculation

Loss Ratio Formula Calculator Example With Excel Template

Expense Ratio - Meaning Formula How To Calculate

Expense Ratio - Meaning Formula How To Calculate

What Is An Expense Ratio Forbes Advisor

Insurance Industry Basics Combined Ratio The Motley Fool