Renters Insurance Claim Time Limit

Property damage caused by water and freezing averaged $6,965 per claim. This time can range anywhere from 30 days to one year.

Geico Auto Liability Insurance Coverage Di 2021

Your renters insurance policy will state how much time you have to do that.

Renters insurance claim time limit. Our denied insurance claim attorneys are here to help. Some categories of personal property coverage have a maximum dollar limit that allstate will pay a policyholder in case of damage or loss. You can also buy an umbrella or excess liability policy, which provides higher limits and broader coverage.

If the situation is ongoing, such as if you’re forced to relocate. Some claims may only take a few hours while others can take longer. Depending on where you live and state law, an insurance company can take several weeks or several months to issue a payout after you file a home insurance or renters insurance claim.

Renters insurance is contents cover designed specifically for renters and tenants with no annual contracts. And although it’s cheap, renters insurance can offer. In most cases, the time limit is 48 and 72 hours.

Most insurance companies do have an allotted amount of time before your claim will not be accepted. Once you've submitted your claim, your renters' insurance company will start the investigation process. If you have questions, don’t hesitate to call your insurance company and ask.

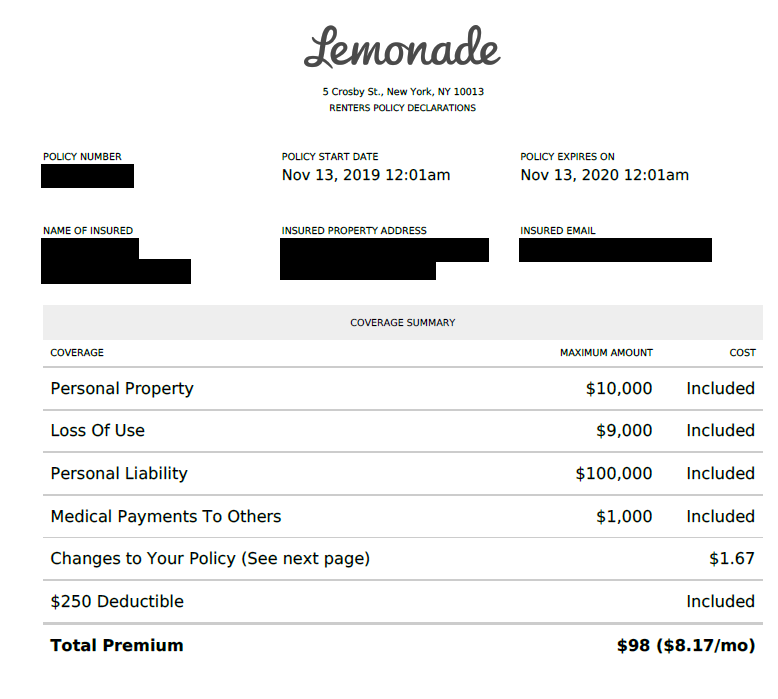

Review your policy, including coverages, limitations, and deductibles related to personal property. These limits usually start at about $100,000, but you can choose to buy more coverage. Actual cash value (acv) — the measure of the actual cash value recovery shall be determined as follows:

Less coverage + higher deductible = lower premium. If you're renting by yourself, with a partner, or with up to 3 flatmates, halifax renters insurance has kept it nice and simple for you. Some experts recommend that you buy at least $300,000 worth of protection.

The amount of time to get your claim taken care of will vary according to how extensive your damages or losses are. If you are at all in doubt about a claim, don’t be afraid to seek help. A flexible monthly contract that you can cancel or make changes to at any time, with no admin fees.

Following a natural disaster that causes widespread damage, insurance companies can extend the claim time limit if they. Finally, here's a helpful way to think about the cost of your renters policy: First of all, your renters insurance in san antonio will cover a claim on day one if necessary.

Most renters insurance quotes include actual cash value, not replacement value for your belongings. Generally, umbrella policies cost between $200 to $350 a year for an extra $1 million of liability protection. Allstate renters insurance protects you and your family in many situations involving your residence and the things you own.

To deny your claim, geico would have to prove the delay was unexcused or unreasonable, or that waiting compromised the insurance company’s ability to investigate the claim and make reasonable. The average claim for bodily injury and property damage was $18,351. More coverage + lower deductible = higher premium.

Typically, an insurance claim related to a recorded loss remains on your record for three to seven years. You may find that the events surrounding the damages can affect the amount of time you have to file a claim. Within these categories, there may also be a limit per single item.

There are three categories of coverage that make up a renters insurance policy: Renters insurance covers the damage or the loss of items within an apartment or rental home, like furniture, appliances, and electronics. Every type of renters insurance coverage comes with a limit, which is the maximum your policy would reimburse you after a covered claim.

The important thing is that the loss cannot have occurred before the policy was in force. This brochure summarizes key information about renters insurance including: If you file one or more claims within this period, your premiums may increase or you could be excluded from coverage.

This is where replacement cost coverage can help. Renters insurance is financial protection for a tenant and their personal belongings. • personal property • deductibles • other ways you’re protected • what may not be covered • optional protection you can buy

Use your insurance company’s mobile application, such as the state farm mobile app, to initiate the claim filing. In kansas, an insurance company has an obligation to investigate a filed claim, whether first or third party, within 30 days from when it was reported. Tenants often have to choose between getting coverage for the replacement cost value of their possessions and the actual cash value of their belongings.

For example, if a fire in your apartment destroys all your property—valued at $10,000—your renters insurance company will reimburse you for that amount, minus your deductible. Geico does not have an official time limit for filing a claim. How long does a home insurance claim stay on your record?

Obviously, renters insurance agents are under restrictions as to where they can write new coverage, decrease deductibles, and the like just before a hurricane. The reason is that geico cannot deny a claim based on late notice. (1) in case of total loss to the structure, the policy limit or the fair market value of the structure, whichever is less, or (2) in case of a partial loss to the structure, or loss to its contents, the amount it would cost the insured to repair, rebuild, or replace the thing lost or injured less a fair and reasonable.

This could mean you may not get enough to buy a new version of the item that was lost. Renters insurance may also provide you with temporary accommodation for a certain period of time if the rental property you live in is significantly damaged from an insured incident. The limits on doing so can range from one to five years, depending on your policy.

You may also be able to add optional extras to your policy, such as portable contents. Claims due to vandalism and malicious damage averaged $4,601. The average claim for loss due to theft and.

In some places, state law requires insurers to pay in a reasonable amount of time. If the insurance company needs additional time to conduct an investigation, it shall every 45 days thereafter send to the insured or claimant a letter setting forth the reasons additional time is needed to conclude the investigation. When damage or theft of your personal property is covered by your renters insurance, you can make a claim for reimbursement up to your policy limits.

Renters Insurance Claim Tips California - United Policyholders

5 Roof Insurance Claim Myths Busted Life Insurance Agent Business Insurance Life Insurance Companies

Pin By Jagdish Bathija On 14-1 Health Insurance Plans Best Health Insurance Family Health Insurance

Writing A Car Insurance Dispute Letter With Sample Homeowners Insurance Insurance Claim Health Insurance

Are You Shopping For An Insurance Policy Learn About How These Common Terms Are Used In Home Health Insurance Coverage Insurance Premium Insurance Marketing

Printable Cms 1500 Forms Superbill Templates - Theranest Medical Billing Free Health Insurance Medical Billing And Coding

Home Insurance Myths -- Busted Homeowners Insurance Home Insurance Home And Auto Insurance

Term Insurance Plan Stay Safe And Insured Health Insurance Plans Best Health Insurance Term Insurance

Pin On Car Insurance

Geico Auto Liability Insurance Coverage Di 2021

Is There A Time Limit For A Auto Insurance Claim To Be Completed Insurance Quotes Cheap Car Insurance Quotes Universal Life Insurance

Does Your Small Business Have A Disaster Recovery Plan Disaster Recovery How To Plan Disasters

Should You Be Charging Sales Tax On Your Online Store Real Estate Investing Rental Property Commercial Rental Property Investment Property

Metlife Insurancethank You Mom For Stressing The Importance Of Life Insurance We Have It And Than Term Life Insurance Life Insurance Policy Life Insurance

Segar Snuff Parlour Bizarre News Covent Garden London 10 Funniest

Top 5 Most Reliable Vehicles By Claim Rate - Endurance Learning Center Reliable Cars Infographic Infographic List

Httpsnsigrouppersonal-insuranceblogall-about-flood-insurance Morethanprice In 2021 Home Maintenance Checklist Home Maintenance Homeowners Guide

Individual Health Insurance Healthinsurancetips Dental Insurance Health Insurance Coverage Buy Health Insurance

Compare Home Insurance Quotes And Rates 2021 - Insurancecom Home Insurance Home Insurance Quotes Insurance Deductible